Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Tags: Insights

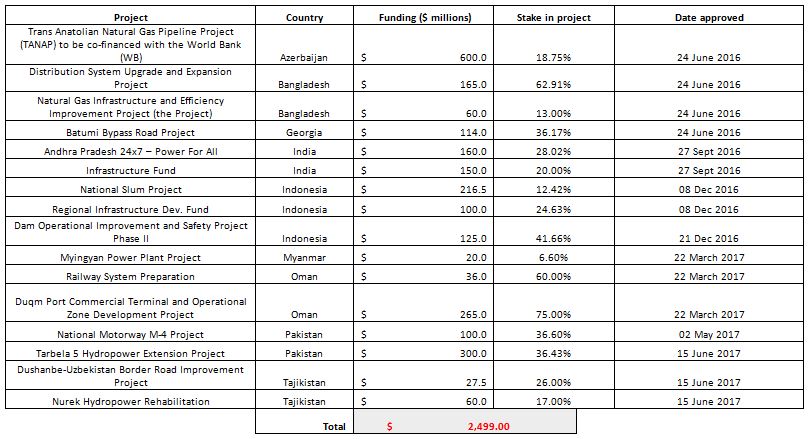

The Asian Infrastructure Investment Bank (AIIB) began approving projects in 2016 and since then has approved a total of 16 projects across Asia, equating to a sum of $US2499 million in loans. Most projects have a focus on energy and transport.

Azerbaijan currently stands at the highest receiver of AIIB loans, followed by Indonesia and Pakistan. Only four of the 16 projects are financed solely by the AIIB. The rest are co-financed with other multilateral development banks like the World Bank and the Asian Development Bank. See a full list of the projects so far below:

The AIIB now has 80 member countries. In terms of voting share, the AIIB has adopted a GDP-based share formula to decide a member’s capital subscription. Different to other banks, GDP is the only benchmark to decide a member’s capital share. The IMF, for example, has a quota formula comprising a weighted average of GDP (weight of 50 per cent), openness (30 per cent), economic variability (15 per cent), and international reserves (5 per cent). The AIIB formula is pro-development, since developing countries including China generally perform better in GDP than by other measures. China therefore has the highest vote share of 27 per cent, then India at 7.9 per cent, and Russia at 6.25 per cent. As the AIIB is an Asian initiative, the aggregate percentage of votes non-regional members can have is capped at 25 per cent, while regional countries (including Russia and the Middle East) can own up to 75 per cent of the share of votes.

The AIIB now has 80 member countries. In terms of voting share, the AIIB has adopted a GDP-based share formula to decide a member’s capital subscription. Different to other banks, GDP is the only benchmark to decide a member’s capital share. The IMF, for example, has a quota formula comprising a weighted average of GDP (weight of 50 per cent), openness (30 per cent), economic variability (15 per cent), and international reserves (5 per cent). The AIIB formula is pro-development, since developing countries including China generally perform better in GDP than by other measures. China therefore has the highest vote share of 27 per cent, then India at 7.9 per cent, and Russia at 6.25 per cent. As the AIIB is an Asian initiative, the aggregate percentage of votes non-regional members can have is capped at 25 per cent, while regional countries (including Russia and the Middle East) can own up to 75 per cent of the share of votes.