This Asia House research briefing presents the second-quarter update of the Asia House Economic Readiness Indices for green finance and digitalisation in Asia, following the publication of the Asia House Annual Outlook in January 2022.

Key Messages

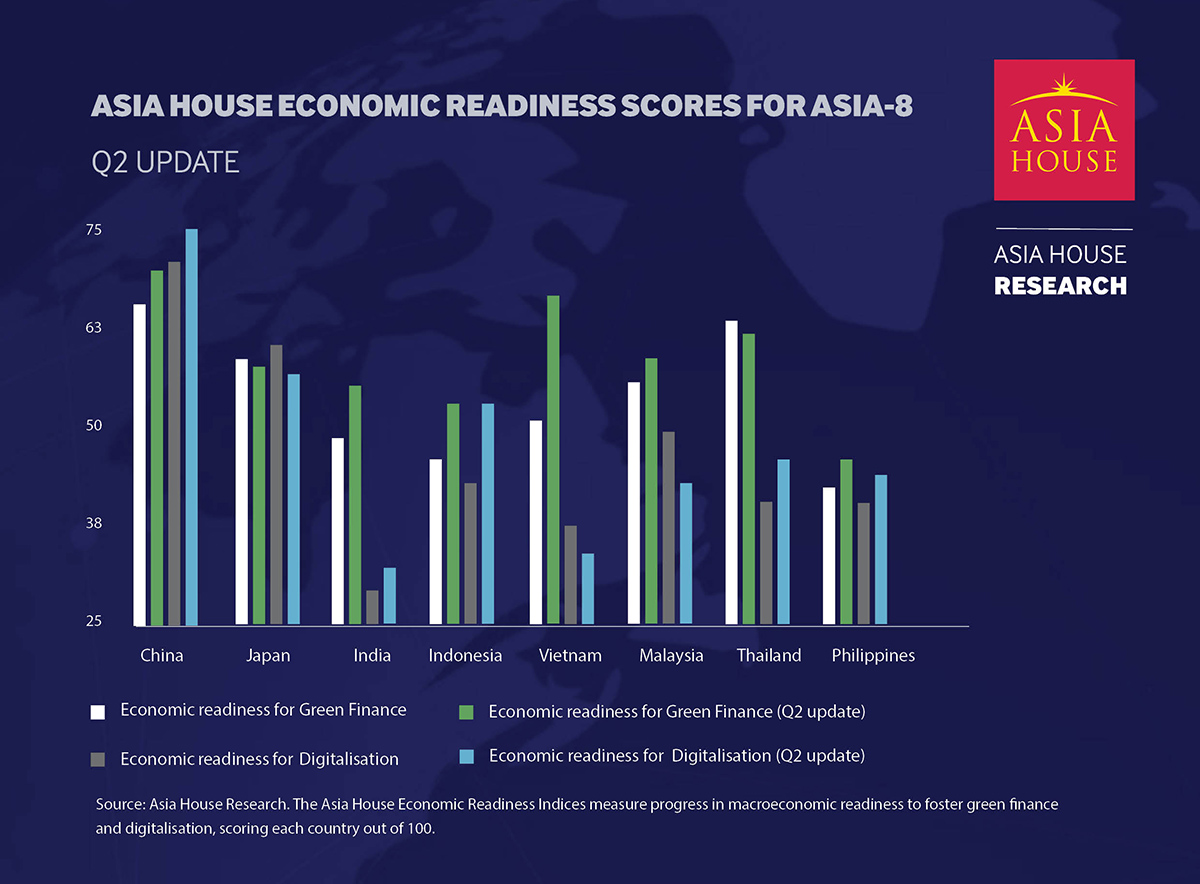

- Asia’s deteriorating growth-inflation mix points to varied developments in the region’s economic readiness scores. Regional currency depreciations will add to inflationary dynamics. However, inward investment has been a significant bright spot.

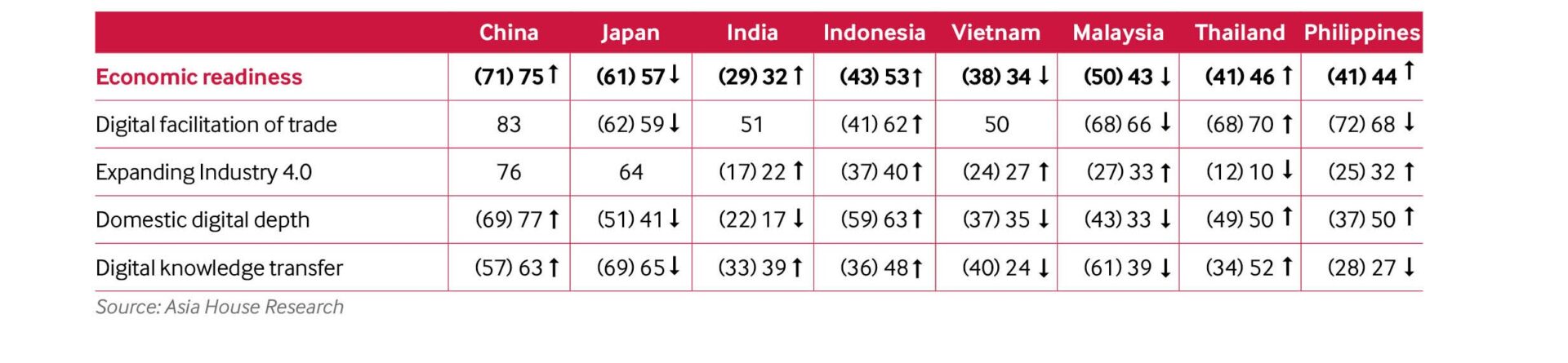

- Encouragingly, Asia’s digital development continues to accelerate, despite headwinds. E-commerce, central bank digital currency (CBDC) and digital payment development and inward foreign direct investment (FDI) have been essential.

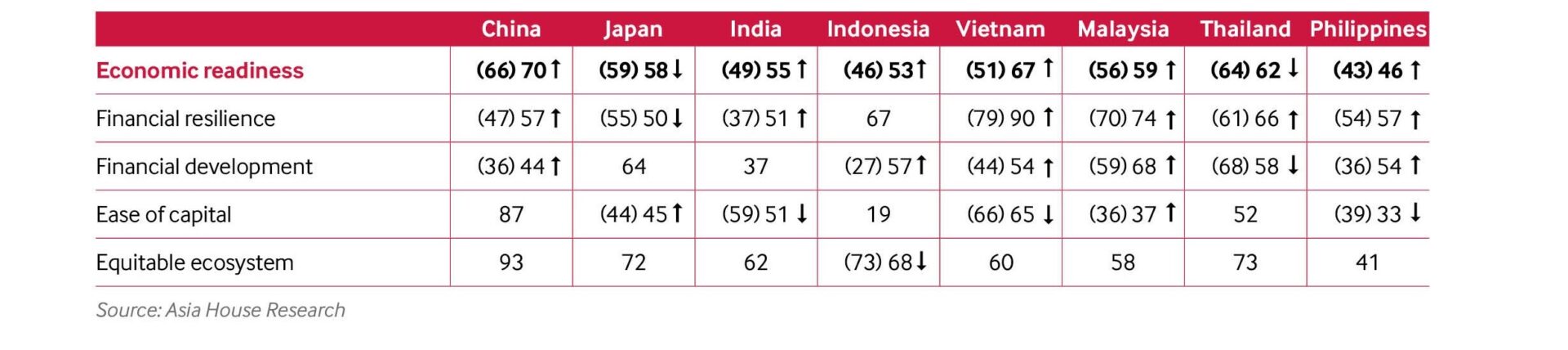

- China’s readiness scores for green finance improved in the second-quarter as a result of improved domestic financial resilience and in its ease of capital sub-index. Its higher digitalisation scores were driven by greenfield FDI and e-commerce.

- Indonesia’s readings showed resurgent strength in both green finance and digital readiness. The quarterly improvements were driven in large part by the resilience in Indonesia’s financial markets and particular strength in inward FDI.

- The knock-on economic impacts from the Ukraine crisis are now increasingly coupled with unanticipated, broad-based and faster global monetary tightening. This will continue to heighten Asia’s economic headwinds.

Economic scarring and geopolitical risk hamper recovery

Amid the current economic and financial uncertainty, Asia finds itself both managing current economic shocks and mobilising a transition to higher levels of income, innovation, resilience and sustainability. Its challenges now include a growing inflationary spiral and unanticipated monetary tightening. The Asia House Economic Readiness Indices for green finance and digitalisation were launched in January 2022 to gauge progress in the region’s eight core economies[1] – the notable greenhouse gas emitters and those most vulnerable to the climate crisis.

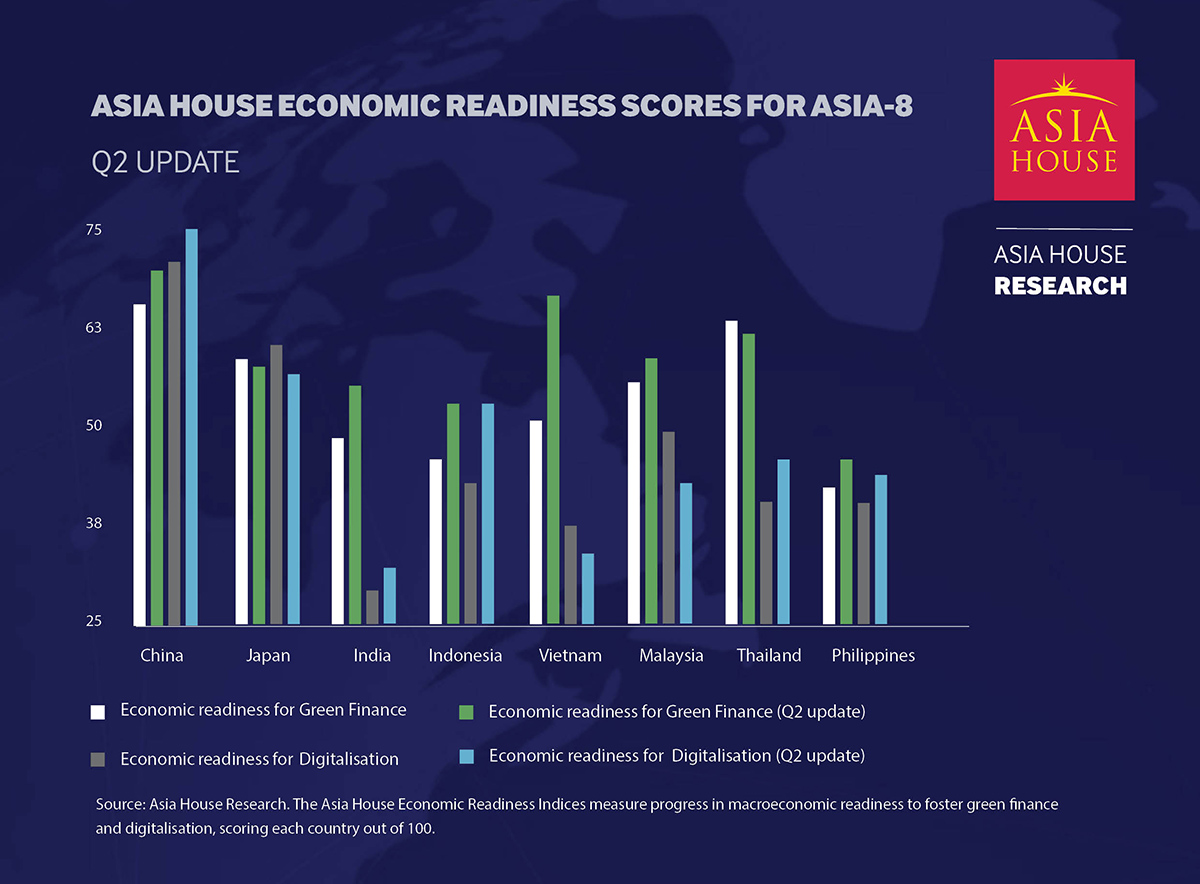

This briefing presents the three key findings from the second-quarter update of the indices for green finance and digitalisation (Figures 1 to 3).

- Higher real interest rates pose a challenge. Amid the current global inflationary spiral, and the breadth and pace of global monetary tightening, the increase in real (inflation-adjusted) interest rates poses a risk to Asia’s economic readiness for green finance. Affordable access to, and the consequent development of, domestic green finance markets is likely to be impacted. The weakness in regional exchange rates may be a precursor to more financial instability. There has been a broad-based increase in real interest rates coupled with regional depreciations.

- Growth in e-commerce continues to spark Asia’s digital development. Resilient and, in some cases, accelerating e-commerce growth across Asia has been a common theme. Quarterly indications of economic readiness for digitalisation have largely been positive across the entire region, including notably in China, where there was an improvement in domestic digital depth. Growth in South East Asia’s e-commerce market and, in part, in ICT trade were also particularly strong, including in Indonesia, Thailand and Malaysia.

- Progress in digital infrastructure development and digital knowledge transfer was evident across the region. Asia’s economies continue, in large part, to announce and pilot policy plans for CBDC development (and related digital payment infrastructure more broadly). This was a particular policy theme, including in India and Japan. Asia’s economies have also been a bright spot for inward greenfield FDI which boosted index readings for China, Indonesia, India and Thailand’s digital knowledge transfer and the diffusion of innovative technology.

Figure 1. Asia House Economic Readiness Index scores for Green Finance

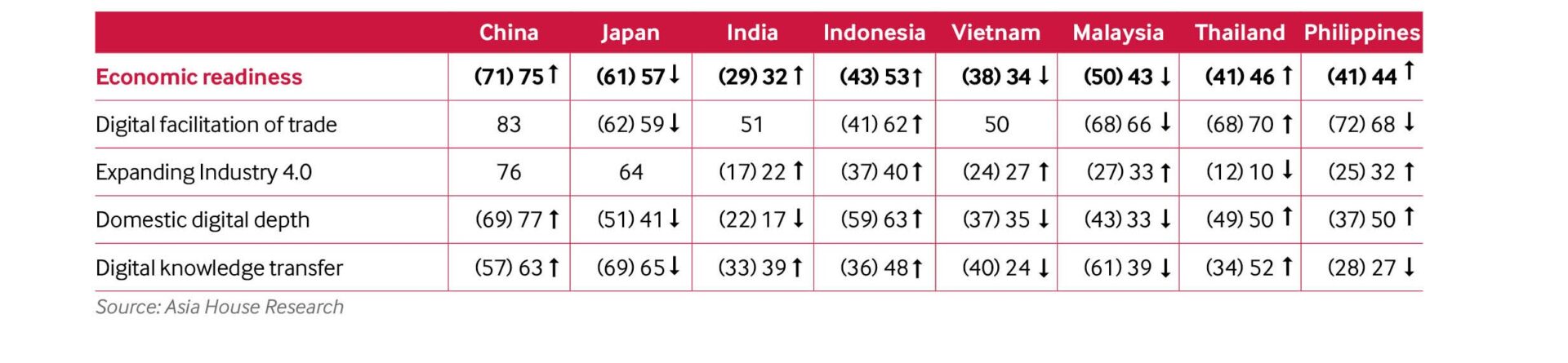

Figure 2. Asia House Economic Readiness Index scores for Digitalisation

Figure 3. Asia House Economic Readiness scores for Asia-8

Economic readiness indices: Country snapshots

Economic readiness in green finance and in digitalisation continues to vary across Asia’s major economies, particularly in the light of continued economic and geopolitical tensions and the specific economic pathways of impact in each economy. Pervasive economic headwinds, including from the acceleration in and the composition of inflation, global monetary tightening, and slower growth, will continue to impact economies through multiple and unexpected pathways.[2]

- China readiness readings for green finance and digitalisation have largely shown resilience, though some weakness emerged in the second quarter. Accommodative monetary policy and continued strength in FDI have offset recent financial volatility (with the latter reflected in slower reserve accumulation and renminbi weakness). Growth in e-commerce boosted China’s digital readiness scores significantly.

- Japan readiness readings have been supported by strength in inward greenfield FDI, the Bank of Japan’s (BOJ) monetary accommodation and domestic credit growth. The continued depreciation in the yen exchange rate has been a key source of uncertainty. Japan’s digital readiness readings were boosted by the BOJ successfully completing its first “Proof of Concept Phase 1” phase in relation to a CBDC ledger.

- India readiness readings showed resilience in the second quarter, supported in large part by stability in its financial indicators, despite currency depreciation. Digital readiness remains comparatively low. And yet, India’s readings were bolstered on multiple metrics, including growth in e-commerce, 2023 plans for a CBDC in 2023, and strength in inward greenfield FDI.

- Indonesia readiness readings for green finance and digitalisation both improved. Its green readiness index was buoyed by the relative stability in the domestic exchange rate. Indonesia’s digital readiness was positively impacted by significant growth in e-commerce which boosted its domestic digital depth sub-index. Inward greenfield FDI was also particularly strong in Indonesia which lifted its index.

- Vietnam readiness scores for green finance improved, owing in part, to credit market developments and comparative resilience in its domestic financial markets. Vietnam’s digitalisation index readings declined in the second quarter. The deterioration in the overall reading declined on account of weaker than anticipated developments in its inward foreign direct investment and e-commerce sub-indices.

- Malaysia readiness scores for green finance were driven by broad-based strength in monetary accommodation and credit market developments. Digital readiness declined somewhat, as with several other economies in South East Asia, and was driven primarily by weaker than anticipated inward greenfield FDI when compared to regional developments.

- Thailand readiness scores showed resilience after having exhibited the largest improvement of all of the economies in green finance readiness in Q1. Credit market developments and real interest rate developments impinged on Thailand’s readings somewhat. The improvement in Thailand’s digital readiness was primarily driven by strength in inward greenfield FDI and growth in e-commerce in the second quarter.

- Philippines readiness score for green finance improved slightly and was driven in part by resilience in its credit dynamics. Similarly, the Philippines’ digital readiness readings were boosted by domestic growth in e-commerce and initiatives aimed at expanding industry 4.0. This offset the decline in the economy’s digital knowledge transfer score from an already low level.

Looking ahead

In the light of the current economic and geopolitical risks, the third quarter could see deterioration in Asia’s economic capacity, particularly in its promotion of green finance. The continued knock-on impact from the Ukraine crisis, now coupled with more broad-based and faster global monetary tightening, will heighten Asia’s headwinds for now. This, in turn, will restrain economic growth significantly (through both consumption and investment) as well as through cross-border trade. Positive developments – including the strength in e-commerce growth, CBDC development, and widespread strength in inward greenfield FDI, will provide underlying support for Asia’s economies to year-end and beyond. Policymakers’ ability to both stand against inflation and ensure financial stability in the form of affordable finance, will be foundational in mobilising green finance.

[1] The eight countries are China, Japan, India, Indonesia, Vietnam, Malaysia, Thailand and the Philippines.

[2]For further details on the composition of the Asia House Economic Readiness Indices, please see the January 2022 issue of the Asia House Annual Outlook.

FIND OUT MORE ABOUT ASIA HOUSE RESEARCH

Join our mailing list to receive Asia House research, analysis and event information direct to your inbox.