Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

By Matilda Buchan, Research Analyst.

Key takeaways

Trade wars are typically fought over industrial and agricultural products – steel, aluminium, vehicles – yet often have unintended consequences for products of national prestige, like locally produced alcohol. On 12 June, the European Commission provisionally concluded that Chinese electric vehicles (EVs) received unfair subsidies and calculated duties equal to the economic damage caused. China has until 4 July to resolve this and has entered talks with the EU; otherwise, additional tariffs ranging from 17.4 to 38.1 per cent will apply on top of the current rate of 10 per cent.[1] The tariffs will apply definitively from November unless a majority of EU states vote against the move. There’s a risk that this could result in a tit-for-tat trade war, with the vehicle industry being the main target. However, geographically sensitive products could also be affected, as China launches their own dumping investigations focused on brandy – specifically French cognac – and Spanish pork. The alcohol sector is nervous and rightly so; previous disputes targeted at Boeing and Airbus resulted in tariffs on Scotch whisky that led to losses of over £1million a day, while China’s recent tariff hike on Australian wine wiped out a huge export market.[2][3]

The direct impact of the EU’s investigation into Chinese EV subsidies will be that environmentally-conscious European consumers will face higher prices. For example, an entry level BYD car priced at €30,000 would face tariffs of €5,250 – an additional cost that BYD would likely pass on to European consumers, or absorb if feasible.[4] Ahead of the EU’s investigation, the Kiel Institute forecast that an extra 20 per cent tariff (confirmed average tariffs are very close at 21 per cent) on EVs would result in a reduction in imports by a quarter, equivalent to 125,000 units worth almost US$4 billion.[5] Consequently, European consumers will likely purchase more locally-produced EVs, but these are more expensive due to higher energy and labour costs.

An unintended consequence of the EU’s investigation is the spill-on effect for the alcohol sector. Four months after the EU announced their investigation which was backed by France, China launched an anti-dumping investigation focused on brandy, of which France accounts for 99.8 per cent of all EU exports.[6] Cognac is a type of brandy and its geographical indication (GI) specifies that it can only be produced in the Cognac region of Southwestern France. If China concludes that France has been selling cognac below market price it can apply import duties that are equal to the damage caused to the domestic sector. China is the second largest market for French cognac after the US, with exports of €720 million in 2023. If China were to impose duties, the price of cognac exports to China would increase and would likely reduce demand and sales. The EU makes up a smaller share of France’s cognac exports so would be unlikely to absorb this excess supply. While European producers’ profits would be hit, Chinese consumers could also lose out as they may have to pay more for the premium product.

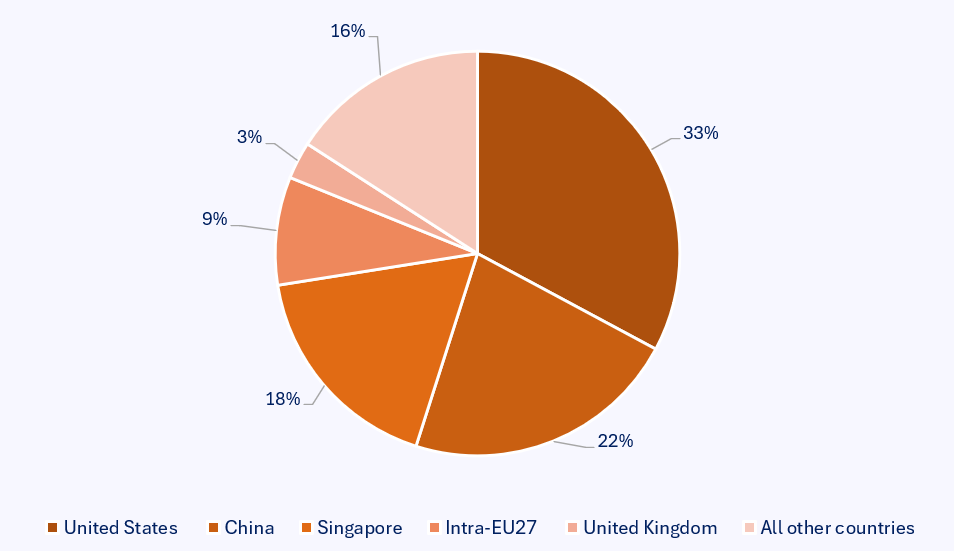

Figure 1 – France’s top cognac consumer markets by export market share in 2023[7]

Source: Eurostat

But why is China targeting French cognac following the EU’s EV investigation? While the two products seem completely unrelated, alcohol is often a highly effective target in a trade war due to meeting the following criteria:

France’s cognac meets these criteria, making it an effective tit-for-tat trade measure. If tariffs were imposed, they would target a specific region, which supports 70,000 jobs.[8] Two major players, the Bureau National Interprofessionnel du Cognac and Fédération Internationale des Vins et Spiritueux, are closely monitoring the situation. The former published a press release stating: “it is clear that the Chinese authorities aim to send a message to the French government by targeting cognac. It is up to our authorities to implement solutions to ensure that one of France’s top export products is not sacrificed”.[9] The French government and EU commission will need to balance multiple demands from different stakeholders.

The cognac industry has good reason to be concerned. Other alcohol products that have been caught up in seemingly unrelated trade tensions have suffered immensely. As part of an ongoing dispute between Boeing and Airbus, in 2019 the WTO ruled that the EU had had illegally subsided Airbus, enabling the US to respond with tariffs worth US$7.5 billion. This included tariffs of 25 per cent on single malt scotch whisky which, over an 18-month period, resulted in a loss in exports of over £600 million.[10] This case illustrates the double-edged sword of GI products: while the label enhances brand recognition and conveys a sense of premium quality, it also makes the product an easy target. In 2020, China introduced tariffs of up to 218.4 per cent on Australian wine and targeted other commodities such as lobster, red meat, and barley which many observers linked to Australia’s probe into the origins of COVID-19.[11] Australian wine accounted for 27.5 per cent of Chinese wine imports before the duties were imposed and exports fell from AU$1.24 billion in 2019 to less than AU$1 million last year.[12][13] Despite the tariffs being lifted in March, long-term damage has been caused, as Australia has lost its market share to other wine producers and now faces stiff competition in the Chinese market.

The future of cognac may be determined by the evolving trade tensions between China and the EU over EVs. As the world becomes more fragmented, there’s a risk that alcohol, as well as other geographic-specific products, will be caught in the crossfire of future disputes. Over 65,000 GIs are in existence, with more than half of these relating to wine and spirits, such as champagne and tequila.[14] Agricultural and food items are widely covered by GIs too, including products such as basmati rice and stilton cheese. Governments will need to consider the direct and indirect effects of trade policy on these often-unrelated sectors as economies imposing tariffs – in response to subsidy or anti-dumping investigations – often do so with the aim of causing maximum damage.

The potential for future EV adoption remains uncertain as the investigation will affect both the price and availability of these vehicles. The two parties have entered talks, but “should discussions with Chinese authorities not lead to an effective solution, these provisional countervailing duties would be introduced from 4 July.”[15] China has proposed lowering tariffs on large-engine vehicles to appeal to luxury automakers in Germany.[16] EU member states have until 2 November to vote against the move, else the tariffs will apply definitively. This may lead to fractures across the bloc, as Germany, with its exposed vehicle market, as well as Sweden and Hungary, have said they do not approve of the move.[17] The tariffs were championed by France and Spain but their stance may change depending on the extent of damage inflicted on cognac and pork exports respectively. The trade-off between pursuing a sustainable energy transition and protecting domestic markets will become increasingly complex as the EU grapples with conflicting pressure and lobbying efforts from member states and industries.

[1] https://ec.europa.eu/commission/presscorner/detail/en/ip_24_3231

[2] https://www.scotch-whisky.org.uk/newsroom/25-months-remain-to-avoid-re-run-of-damaging-25-us-tariff/

[3] https://www.oecd-ilibrary.org/trade/trade-impacts-of-economic-coercion_d4ab39b9-en

[4] https://www.theguardian.com/business/article/2024/jun/12/eu-import-tariffs-chinese-evs-electric-vehicles-trade-war

[5] https://www.ifw-kiel.de/publications/news/eu-tariffs-against-china-redirect-trade-of-evs-worth-almost-usd-4-billion/

[6] https://www.thespiritsbusiness.com/2024/02/why-is-china-investigating-cognac/

[7] Analysis on “cognac, in containers holding <= 2 l” (HS 22082012)

[8] https://www.cognac.fr/en/news/chinese-anti-dumping-investigation-the-cognac-appellation-confirms-its-serious-concerns/

[9] ibid

[10] https://www.scotch-whisky.org.uk/newsroom/25-months-remain-to-avoid-re-run-of-damaging-25-us-tariff/

[11] https://www.reuters.com/markets/commodities/china-lifts-tariffs-australian-wine-ends-three-year-freeze-trade-2024-04-02/

[12] https://thediplomat.com/2024/03/china-lifts-heavy-tariffs-on-australian-wine-as-ties-improve/

[13] https://www.unsw.edu.au/newsroom/news/2024/04/china-finally-removed-crushing-tariffs-Australian-wine

[14] https://www.wipo.int/edocs/pubdocs/en/wipo_pub_941_2019-chapter5.pdf

[15] https://ec.europa.eu/commission/presscorner/detail/en/ip_24_3231

[16] https://www.bloomberg.com/news/articles/2024-06-24/china-floats-perks-for-german-carmakers-in-bid-to-stop-ev-levies

[17] https://www.ft.com/content/0545ed62-c4b9-4e8a-80fa-c9f808e18385

Asia House is working with governments across Asia, the Middle East and the West, as well as multilateral organisations and the private sector to drive commercial and political engagement around key issues in global trade. For more information on our research and programmes, please contact Katie Reid, Stakeholder Engagement Associate via katie.reid@asiahouse.co.uk