Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

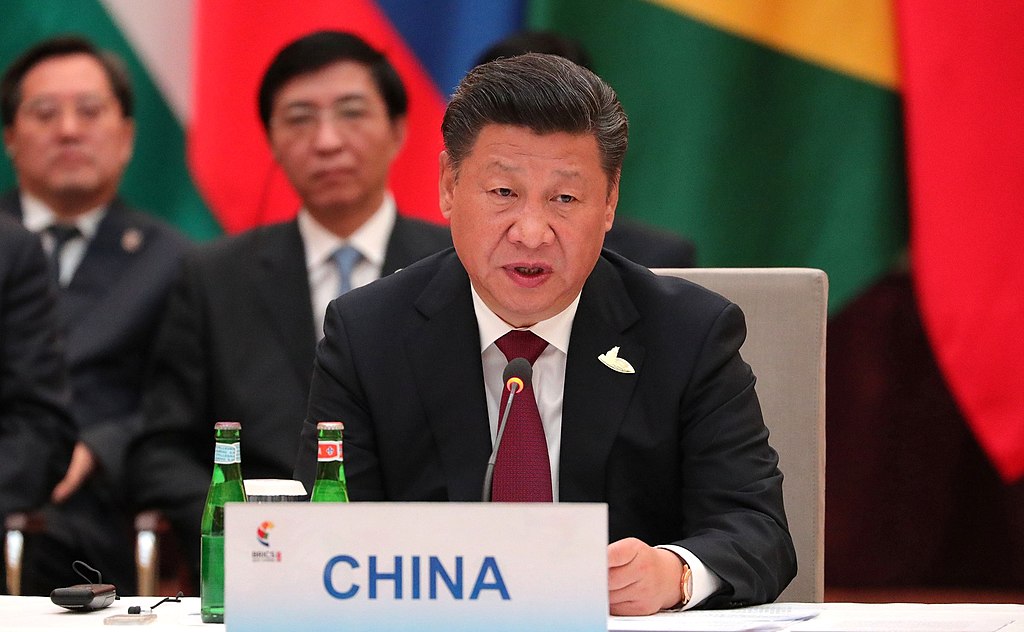

Following the Communist Party of China’s (CPC) Central Committee’s Fifth Plenum at the end of October, the CPC published an outline of proposals for China’s Five-Year plan to 2025 and long-term goals to 2035. The proposals set out a more inwardly-focused approach in comparison to the export-oriented growth of the past few decades, with objectives centred around strategic self-sufficiency and domestically driven growth.

This Asia House Advisory briefing highlights and expands on key takeaways from the Fifth Plenum and recent policy signals for China’s economic trajectory over the next five years and beyond.

– No targets, but a focus on quality over rapid growth – Much has been made of the choice not to set GDP targets at the Fifth Plenum. However, this signals an increased sophistication of approach moving forward where quality growth focused on innovation, health and the environment will trump percentage point growth at any cost.

– Push for innovation driven by strategic necessity – Security of supply in components such as semiconductors has driven strategic autonomy to the top of the agenda. The logical next step is global leadership in emerging technologies such as AI, energy storage, and biotech.

– Doubling down on domestic consumption – The continued growth of a middle class will be supported by wage growth and the expansion of economic opportunities beyond key urban centres in an attempt to create the new furnace of the Chinese economy.

– Building a more regionally-balanced ‘Digital China’ – The expansion of economic opportunity will be supported by the development of physical and digital infrastructure, greater urbanisation and increased connectivity between rural areas and key economic centres.

– Green development is still a priority, with an emphasis on decarbonisation – This Five-Year Plan will be crucial to achieving the target of net zero emissions by 2060 announced by President Xi earlier this year through sustainable finance, carbon pricing, and green technologies.

The internal focus does not leave foreign engagement out of the picture and there are positive implications and opportunities for international businesses. Foreign technology and capital that are aligned with China’s goals will be welcomed, and some degree of further opening up is expected to accommodate this. The strategic expansion of China’s consuming middle class will create opportunities and scale, especially for companies who venture beyond China’s top tier cities.

The Belt and Road Initiative will also continue, though likely in a more sophisticated, less provocative way. However, competition in strategic sectors with state owned enterprise (SOEs) and government champions will mean foreign entities will continue to face difficulties operating in certain areas of the economy. In response to the geopolitical situation, China is ‘digging in’ on aspects of its economic strategy that will sustain the stand-off with the US, and potentially lead to greater friction with the EU and other major economies. US-China decoupling will continue, if not accelerate, and will be driven by both sides.

Multinationals operating elsewhere in Asia may also see increased competition from Chinese firms as they seek economic ties within the Asia-Pacific region. While there is much left to be decided in the details of this Five-Year Plan, international firms with investments, customers, and supply chains in China should be prepared for significant changes, both within China and in the way it engages with the rest of the world.

On 3 November, the Communist Party of China (CPC) published a “proposals” paper for China’s forthcoming 14th Five-Year Plan and long-term goals for 2035. The document, approved by the Central Committee’s Fifth Plenum in Beijing, sets broad goals to turn China into a technological powerhouse and shift to a quality-oriented growth model driven by domestic firms and markets. It also reflects confidence in China’s model as the economy bounces back after successfully controlling COVID-19 within its borders.

Five-year plans continue to play a major role in China’s economy, setting key targets for economic and social policy that guide ministries and industrial development. The forthcoming plan, to be approved in March, is particularly significant as the CPC prepares for a post-pandemic world it sees being shaped by rivalry, economic uncertainty, and the splintering of global value chains. Since May, the CPC’s response to these challenges has coalesced into the ‘dual circulation strategy’, a concept that is not widely understood outside China but is set to be a central theme of the five year plan. The main thrust of the strategy is reducing dependency on foreign markets and technology by promoting consumption, import substitution for key inputs, and indigenous innovation – the domestic aspect of the circulation. This is supplemented by an external aspect – foreign trade and investment.

Focus on quality over rapid growth

Rather than high numerical targets set in the past, the 14th Five-Year Plan will stress ‘quality’ growth oriented to innovation and living standards such as health and environmental indicators. The 13th Five-Year Plan (2016- 2020) aimed for average annual GDP growth of 6.5 per cent. Amid the pandemic uncertainty, this year was the first since 1990 that no annual growth target was set. Still, China has recovered faster than any other country and is the only major economy expected to grow this year.

The Fifth Plenum suggests future growth targets will be more subtle rather than abandoned entirely. President Xi said it is “completely possible” to double China’s per capita income by 2035, which would require annual GDP growth of 4.7 per cent over the next 15 years. More will be known in March 2021 as to whether there will be an explicit growth target for the upcoming period.

Push for innovation becomes strategic priority

Innovation is an overarching priority to meet various goals of the plan. The concept of ‘technological self-reliance’ was elevated to become a pillar of the national development strategy as China aims to become a high-tech superpower by 2035. The threat of embargoes has sharpened policymakers’ focus on overcoming China’s technological vulnerabilities such as the supply of semiconductors. The new Strategic Emerging Industry plan released in September indicates a more targeted approach under the dual circulation strategy, listing specific products and components rather than broad sectors as in previous policies such as Made in China 2025.

Aside from plugging shortcomings, the government will direct more resources towards building global leadership in the next generation of sectors and technologies, such as network equipment, artificial intelligence, quantum computing, biotech, and new energy vehicles. These ambitions mean a more activist industrial policy led by ‘stronger, better, and bigger’ state-owned enterprises (SOEs) to secure technology and resources. New R&D investment targets will likely increase from 2.5 per cent of GDP under the previous plan, with guided financing and R&D tax incentives to cultivate innovative private firms.

Government-led indigenous innovation has had mixed results to date. But with the stakes higher than ever, resource allocation schemes are becoming more sophisticated. International firms can expect Chinese firms to become formidable competitors in a growing range of sectors.

Doubling down on domestic consumption

Boosting consumption, already a key part of China’s efforts to rebalance the economy, has gained impetus amid bleak prospects for external demand. To achieve this, the CPC will seek to raise productivity and wages, strengthen the social safety net, and expand economic opportunities in smaller towns and rural areas. The government is also supporting manufacturers to retool export-focused production lines for the domestic market. This reorientation will likely accelerate in the upcoming period.

Infrastructure: Building a more regionally-balanced ‘Digital China’

The 14th Five-Year Plan will see major infrastructure investments to support emerging industries, improve urban environments, and to close the gap between affluent cities and less-developed interior and rural regions.

China aims to become a ‘network power’ by developing technologies grouped together under the term ‘New Infrastructure’, such as 5G, cloud computing, smart cities, and the industrial internet. This will accelerate the digitalisation of industry and consumption already spurred by COVID-19. Meanwhile, the ‘New Urbanisation’ initiative will see further investment to upgrade transport networks, residential neighbourhoods, and rural-urban linkages such as cold chains. Rather than concentrating resources in megacities and provincial capitals, President Xi has called for the development of urban clusters on the coast and smaller cities inland.

Green development still a priority, with more emphasis on decarbonisation

The plan is expected to set more aggressive green targets for energy, buildings, and industry following China’s recent pledge to hit peak emissions by 2030 and be carbon neutral by 2060. Steps to achieve this will include promoting sustainable finance, pricing carbon, and government support for emissions-reducing solutions such as green buildings, renewable energy, and ‘New-Energy Vehicles’.

Opening-up and the Belt and Road

CPC leaders have taken pains to emphasise that the domestic focus of the dual circulation strategy does not mean China is turning away from foreign trade and investment. The proposals reiterates pledges for fair market supervision and further opening up, particularly in services, and to liberalise the financial sector to promote RMB internationalisation. Efforts to promote the Belt and Road Initiative will continue, but facing international scrutiny and tighter finances at home, more focus is expected on risk mitigation, sustainability, and cooperation with third parties.

The Five-Year Plan and long-term goals for 2035 will have profound implications for China’s foreign investment environment and future role in the global economy. The following are key considerations for international businesses engaged in China or seeking to enter this lucrative but challenging market.

Dual circulation’ is a double-edged sword for foreign investment

Despite its inward focus, the dual circulation strategy presents significant opportunities for international business, which the CPC sees as a vital conduit for foreign technology and capital. Foreign investment aligned with goals around innovation, self-sufficiency, and sustainability will be particularly welcomed. Wider market access is expected in some sectors as China seeks to win over the international business community, particularly in financial services. This follows recent opening in insurance, securities, RMB payment clearance, and credit ratings, as well as better channels to invest in mainland bonds and stocks.

On the other hand, the dual circulation strategy heralds a more expansive concept of national security and a growing list of sectors tagged for self-sufficiency and state intervention. This will impact market conditions for some key inputs such as base chemicals as domestic production expands to reduce import dependency. International businesses in these strategic sectors will have to contend with stronger SOEs. The private sector is also increasingly subject to non-market factors, potentially impacting the behaviour of local business partners.

Tapping consumer growth

The dual circulation strategy will accelerate the rise of the Chinese consumer, already among the most promising growth stories for the post-pandemic world. To make the most of these opportunities, international businesses must orient their mindsets and operations towards fast-moving and diverse local markets and find ways to reach dispersed high-growth areas beyond their usual first-tier metropolis comfort zones. Partnerships with Chinese firms with strengths in digital or distribution are one way to do this.

The reconfiguration of Chinese manufacturing

Supply chain trends driven by rising costs and trade frictions are set to continue under the five-year plan. Chinese manufacturing will be geared towards local preferences and standards as lower-value export-oriented production moves elsewhere. COVID-19 and the growing use of sanctions in different jurisdictions is seeing firms shift from a “just-in-time” to a “just-in-case” approach, though constraints amidst the pandemic will slow the actual redeployment of resources. Buoyed by policy support for automation and smart technologies, a distinctly Chinese model of service-oriented manufacturing is emerging which links players along the value chain via realtime data exchange. This will favour collaborative models that allow firms to stay close to customers, shorten product cycles, and tailor solutions to niche demands.

China’s external relations

The Fifth Plenum confirms that the CPC is digging in for a prolonged confrontation with the US. China’s drive for technological dominance will also exacerbate frictions with the EU, which in many ways has more overlap with the CPC’s economic ambitions. The role of SOEs in the economy, which is set to grow, has already been a sticking point in drawn-out negotiations on the EU-China Investment Agreement. As doors close in the West, China is keen to deepen ties and confirm trade agreements with closer neighbours to help shape decoupling on its own terms. Amid the fallout from COVID-19, in the first half of 2020, ASEAN surpassed both the EU and US to become China’s largest trading partner for the first time – maybe a sign of things to come.

Planning for a fractured global economy

International businesses need a long-term vision of what decoupling and the five-year plan mean for global operations. China’s market will grow in importance and gain influence in setting standards. It is also likely that decoupling will continue if not accelerate. This calls for international businesses to develop global strategies that accommodate these two realities and the challenges of operating across divergent systems for standards and technology.

The Fifth Plenum is one step in the ongoing policymaking and implementation process. The proposals covered in this briefing will now be codified into the national five-year plan, set for release in March 2021. This will be followed by plans for specific issues and sectors that break down the national plan into more detailed targets, providing a valuable reference for investors to predict how markets will evolve and to align strategy and corporate positioning with national objectives.

Ed Ratcliffe

Head of Advisory

Asia House Advisory

Junni Park

Advisor, China

Asia House Advisory

Charlie Humphreys

Director of Corporate Affairs

Asia House

Published: 9 November 2020.

This analysis was produced by Asia House Advisory. For more information about China-focused consultancy and research services provided by Asia House Advisory, please contact ed.ratcliffe@asiahouse.co.uk

To receive analysis like this directly to your inbox, subscribe to our mailing list.