Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

The remarkable growth in China’s e-commerce sector heralded by the COVID-19 crisis is likely to endure beyond the pandemic, leading industry figures said today (16 June).

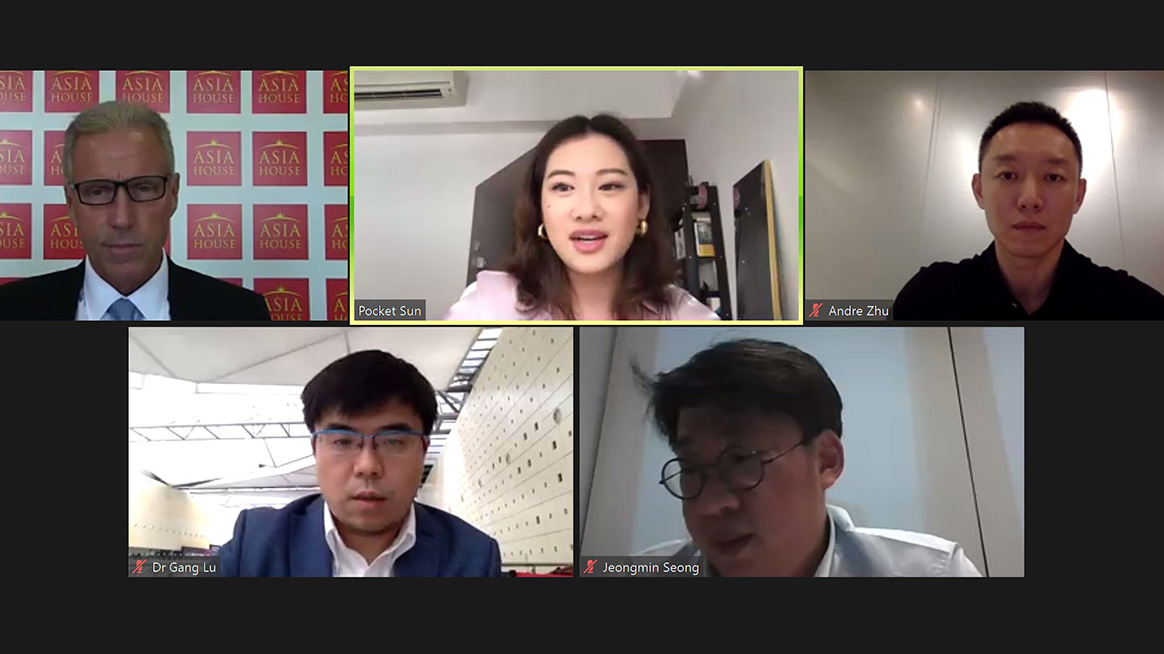

Speaking during an Asia House webinar co-produced with TechNode, a panel of key market players, analysts and venture capitalists shared their views on the dramatic shifts taking place across China’s digital economy.

And the clear consensus was that e-commerce is only going to grow.

“COVID-19 is causing an acceleration and amplification of many pre-existing trends,” Jeongmin Seong, Partner at McKinsey Global Institute, said, noting that China was already a global leader in the digital commerce space.

“The e-commerce share of total retail [in China] is about 25 per cent, and mobile payment penetration is about 80 per cent,” he said. “This is two or three times higher than that of other advanced economies.

It is therefore “very natural” to see such results coming from China, he added.

Jeongmin’s point is borne out by the success of companies such as Pinduoduo Inc, described by Forbes in December 2019 as ‘the fastest growing e-commerce startup in the history of China.’

Andre Zhu, Senior Vice President of Strategy and Legal at Pinduoduo Inc, attributed this success to the platform’s fresh approach to online retail, as well as the broader dynamism in China’s digital economy.

Rather than the search-based transactional nature of some e-commerce companies, Pinduoduo seeks to emulate the social aspects of shopping, Andre said.

“Our goal is to move that shopping experience from offline to online, and bring more fun and interaction – from a shopping mall experience or farmers’ market – into the digital market place.”

This entertainment aspect is likely to drive further e-commerce growth, Andre added. “We’re certainly seeing the trend of e-commerce going in that direction – of being more fun, more social and more interactive.”

All of this, of course, represents a major boon for the Chinese economy. Writing in TechNode on 15 June, Asia House’s Charlie Humphreys highlighted the remarkable figures posted by China’s tech firms in Q1, when the lockdown was at its peak.

JD.com reported Q1 year on year growth of 20 per cent, Alibaba reported 22 per cent, and Pinduoduo, an eye-catching 44 per cent.

Given this remarkable growth, could e-commerce support broader economic recovery beyond China, and in the wider Asia region? This was a question Michael Lawrence, Chief Executive of Asia House, put to Pocket Sun, the entrepreneur and venture capitalist who co-founded SoGal Ventures.

“The short answer is yes,” Pocket said, but added that – while there have been some notable shifts during the lockdown in Singapore, where she is based – the digital sector there feels like “China five years ago”.

China’s e-commerce size is three times that of the US, Pocket said, due in part to the country’s innovators “skipping” a number of development steps.

“We skipped desktops – most Chinese e-commerce [firms] have no websites, which is very different to US e-commerce, or anywhere else.” This means consumers go straight to mobile, which has also seen a boom in mobile payments – bypassing a transition to credit card payments in China’s digital journey. Other markets will therefore struggle to emulate China’s success.

“I believe that e-commerce and scalability are very unique to China,” Pocket said.

That scalability has enabled a momentum to develop which is showing no sign of slowing, according to Gang Lu, the Founder of TechNode – one of the world’s leading digital sector news platforms focusing on China.

While sceptical of the hype around digital services replacing all offline activities, “which we will need,” Gang was nonetheless bullish about the future of China’s e-commerce sector.

“I think it’s unstoppable,” he said. “With or without the pandemic, it was always unstoppable.”

This event, ‘COVID-19, e-commerce and the rise of new retail in China’, was co-produced with TechNode. Find out more about becoming a member of TechNode, or subscribe to their newsletter here.

WATCH IN FULL: COVID-19, E-COMMERCE AND THE RISE OF NEW RETAIL IN CHINA