Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Charlie Humphreys, Director of Corporate Affairs at Asia House, explores the shift in global trade.

The 49th ASEAN Economic Ministers Meeting (AEM) was held in Manila in September along with associated meetings with trade officials from China, Japan and India. While many of us who focus on Asia and trade and investment followed this closely, it largely passed without major coverage in the international media, and yet the significance of these discussions to the global trade regime is considerable. It is through these discussions that Asian economies can increasingly influence the rules which govern global trade. While this cycle of high-level discussions is centred around the efforts to solidify a trade bloc in Asia which enhances regional trade and investment flows, the long-term implication is the ability of countries in Asia to attain a much greater level of impact on the global order.

Ahead of the AEM, the atmosphere in Manila was positive, although some of the underlying concerns were palpable. For the international business community, including both Asian as well as Western multinational companies, the ability of Asian countries to progress regional trade agreements is now seen as one of the main drivers for continued commitment to trade openness. Speaking to some of the ministers on the sidelines, as well as senior officials from the ASEAN Secretariat, it was clear that the group of negotiating parties now see the real challenge as implementing the existing agreements to ensure that they can successfully move forward with the proposed future arrangements.

ASEAN Plus Six

The main topic of discussion among the ten ASEAN member states was the implementation of the agreements embodied in the launch of the ASEAN Economic Community (AEC). This is an enhanced trade agreement between the member states which aims to harmonise regulation and reduce political trade barriers between the signatories. The broader aim is to create a common production base which will allow the ASEAN bloc to trade as a single economic entity with the major trading partners in the region, as well as with the major economies in Europe and North America, among others.

Built onto the AEC, which officially launched at the start of 2016, is a broader trade agreement with major significance. The proposed Regional Comprehensive Economic Partnership (RCEP) aligns the bilateral free trade agreements signed between ASEAN and Australia, China, India, Japan, New Zealand and South Korea. This agreement, which is currently under negotiation, will cover a region containing approximately half of the world’s population and over a third of global GDP. Whilst the RCEP does not contain some of the highly integrated trade agreements initiated by developed economies, it provides a more open structure for additional members to join and is seen, by many of the participants at least, as a more sustainable, realistic type of trade agreement for the Asia-Pacific region.

Given the current global context, this is even more important to those whose prosperity depends on international markets. Under President Donald Trump’s administration, the US has withdrawn from the Trans-Pacific Partnership (TPP) Agreement, is renegotiating the North American Free Trade Agreement (NAFTA) which governs trade with its immediate neighbours, and is seeking to alter the terms of the US-Korea trade agreement in favour of the US. The UK’s decision to withdraw from the EU somewhat mirrors the economic nationalism demonstrated by the new US trade policy, which may indicate a move away from openness to global trade and the adoption of some protectionist measures. That said, the UK Government insists it remains a champion of free trade, and has established a new department to develop new trading relationships.

Asia on the other hand, has been a beneficiary of the increasingly open trade regime arising from WTO rules as well as bilateral and multilateral trade agreements, but is also now the most dynamic region for international trade and investment, and therefore a major proponent of maintaining the momentum behind regional, and ultimately global, economic integration. China is the largest Asian economy, with a major interest in concluding regional trade agreements. Many commentators have noted that while ASEAN is the crucible of these multilateral trade agreements, China is driving the progress.

An additional dimension is China’s Belt and Road Initiative. China has also established the Asian Infrastructure Investment Bank (AIIB), a multilateral development bank to focus on financing the major infrastructure development needed across developing countries in Asia. The two devel-opments are not officially connected, but are highly complementary, and together they clearly demonstrate China’s ambition to be a regional po-litical and economic force for developing markets beyond its borders and international economic engagement.

Businesses operating in international markets cannot afford to ignore the developments taking place in Asia, and the implications that this will have on international trade in the medium and long term. In the short to medium term, there are additional considerations for international businesses wishing to take advantage of this economic dynamism across Asia.

The impact of outbound Asian trade and investment

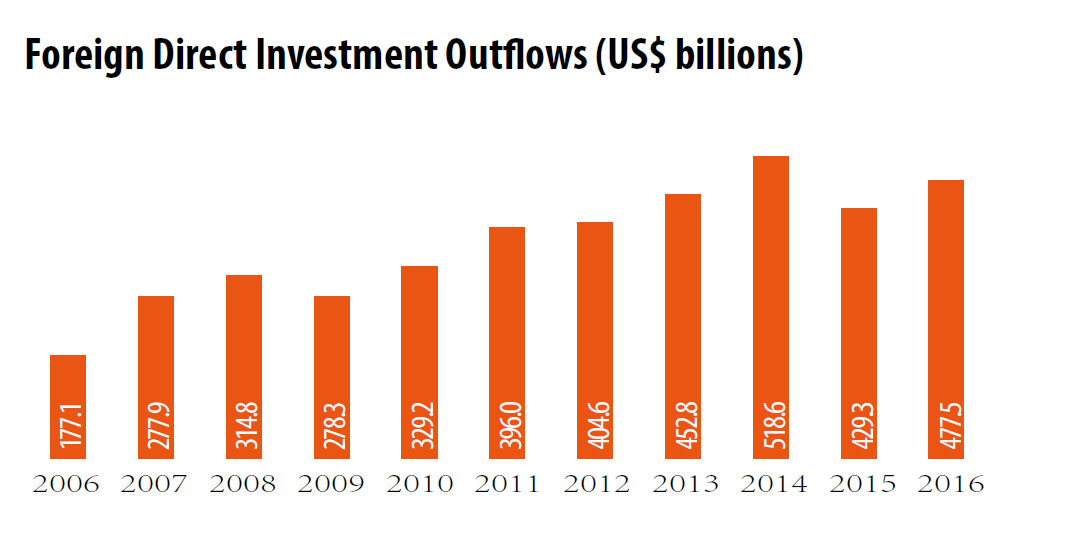

In line with these political developments, Asian trade and capital is assuming an ever more dominant position within the world economic system. While South, Southeast, and East Asia are continuing their decade-long role as the main destination of international investment, it is important to note the growing scale and importance of FDI outflows from the region. The combined outbound investment of the region currently amounts to roughly US$477.5 billion.

This staggering level of capital outflow is even more impressive considering the rapid regional rise to global importance, with only Europe (narrowly) providing more outbound investment. The explosion of Asian FDI outflows over the past decade is reflected in the following data from the United Nations Conference on Trade and Development:

Despite some fluctuation, a feature that is not unique to Asian-sourced investment, outflows from the region have steadily increased at a rate of roughly 12 per cent per annum since 2007. For comparison, this growth rate is approximately double the comparable figure for North America (5.9 per cent). More importantly, Asia’s share of global capital flows, in terms of FDI, has skyrocketed from 13 per cent in 2006 to 32.9 per cent last year.

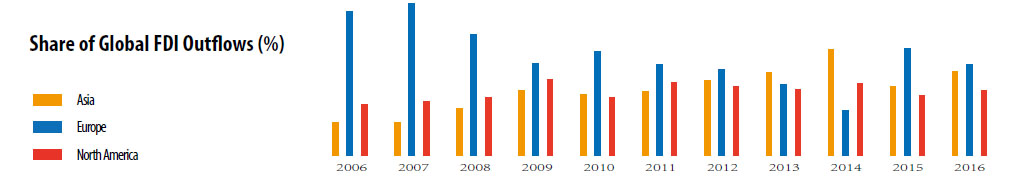

While North America has maintained some degree of stability in its relative share of outbound investment, fluctuating between 20 and 25 per cent for the past decade, the clearer sign that there is a shift towards Asia in terms of trade and investment is the decline of European outbound investment in the face of East Asian ascendance. Ten years ago, European outflows still accounted for 56.1 per cent of worldwide FDI. That figure has now dropped to 35.4 per cent, effectively putting Europe on the same level as Asia regarding its importance as a source of outbound investment. This growing global centrality of Asian capital is shown in the following comparison of global FDI shares:

Clearly, Asia is an increasingly important source of international investment capital and is thus becoming an ever more vital part of the global economy. The concurrent shift of priorities towards new, emerging financial centres represents both a challenge and an opportunity to companies attempting to engage with international trade and investment in order to become truly global players in their industries.

Major commercial opportunities associated with the deployment of Asian FDI have therefore expanded significantly via the investment and capital received by host countries. The late 20th and early 21st century saw an ‘East meets West’ phenomenon being driven by the expansion of Western multinational companies into Asian countries joining the global economy – most notably China’s accession to the WTO in 2001. The run-up to the middle of this century, however, is most likely to be characterised by flows expanding in the other direction, as Asian countries demonstrate strong growth and an increased capability to enter international markets. This, combined with a greater drive and ability to develop trade policy in their own region in order to suit their own needs, and also influence the global trade regime, enhances the commercial opportunities associated with many Asian countries.

For Europe and North America, this has the potential to offer mutually beneficial solutions to companies operating domestically and internationally. Incoming investment from, and growing trade with, the faster growing Asian countries can provide additional growth opportunities for these established economies. Companies with established commercial operations in Asia may be well placed to benefit from the growing outbound investment flows from Asian countries, whether that investment is deployed in Asia or beyond. The Belt and Road Initiative, and many other efforts to develop infrastructure in Asia, are likely to provide enhanced connectivity to facilitate greater trade flows within Asia and between Asia and other major markets, alongside the advent of new technologies which are digitising and revolutionising markets across the planet.

Among the Asian trade specialists converging in Manila for one of their many rounds of talks, I picked up on the concern among some that the changing trade and foreign policy in Europe and North America could cause disruption to global trade flows. The main feeling, however, was positivity surrounding the intentions of the Asian countries present to continue working on opening up trade and investment opportunities. While Donald Trump and Brexit may be grabbing the headlines currently in the West, the steady progress of Asian trade talks and the expansion of Asian economies’ involvement in global markets may have a more far-reaching impact.

Charlie Humphreys is Director of Corporate Affairs at Asia House. Till Schofer, researcher at Asia House, contributed to this article.

This article was originally published by ABP in their ABP Quarterly Review publication.