Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Thailand’s Minister of Finance has, in a speech he delivered at Asia House, outlined a series of reforms that the military government is carrying out to boost the country’s flagging economy.

Addressing business executives, consultants, bankers, investors and industrialists at Asia House in London, HE Mr Sommai Phasee explained how the current government which took control in May 2014 in a military coup hoped to restore confidence in the economy ahead of a general election at the end of 2016.

Thailand’s economy has been affected by three factors. Firstly, the global economic slowdown has hit the country’s exports, not just exports to the US and EU, but particularly exports to China, a country that has seen its own economy stall.

Exports account for about 65 percent of Thailand’s GDP. The country exports manufactured goods such as electronics vehicles machinery and equipment, as well as agricultural goods such as rice and rubber.

Secondly, low commodity prices have negatively impacted the Thai economy. Thirdly, Thailand’s weather has fluctuated in recent years between severe droughts and severe floods and this year the farmers have been affected by a severe drought which has dealt a further blow to the economy. Agriculture is still a major part of the Thai economy employing 49 per cent of the population.

“We expect the growth momentum to continue and project that the Thai economy in 2015 will expand around three per cent,” Mr Phasee said. “The growth projection is supported by a rebound in private consumption as indicated by an 11 per cent increase in domestic VAT collection and a high growth in tourist arrival,” Mr Phasee said.

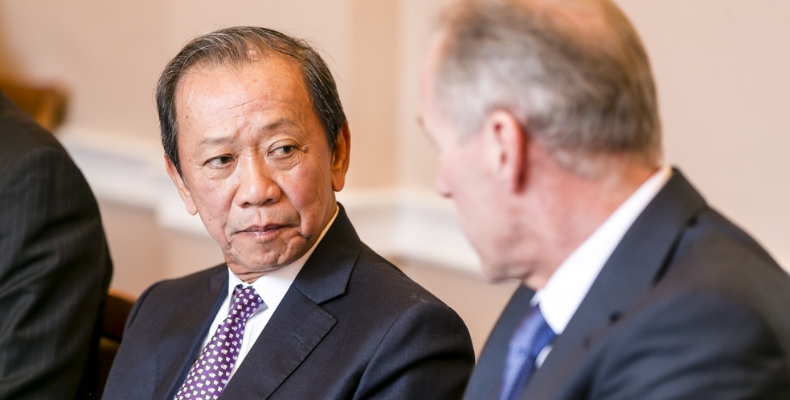

HE Me Sommai Phasee gave a speech at Asia House in which he talked about what should make Thailand attractive to European investors. Image copyright: Miles Willis Photography

“We want to keep it [growth] as high as possible by the end of the year,” Mr Phasee said, adding he did not expect GDP growth to be higher than five per cent in the coming years.

He admitted three per cent was “moderate growth” compared with Thailand’s past record putting that down to “an unfavourable external environment” and “structural impediments that have eroded Thailand’s competitiveness.” Between 1985 and 1995 Thailand was one of the fastest growing economies of the world with a growth rate averaging at eight per cent. Nevertheless unemployment levels remain below one per cent.

Mr Phasee then justified the 2014 military coup that put the army in charge of the country. “Prior to that Thailand had gone through a very difficult period of political polarisation, prolonged street protests day and night and a less-than-functioning Government, which had affected all aspects of Thai society,” he explained.

He added that apart from the political situation, other events had deeply affected the Thai economy which had led to the unrest. These included the 2011 floods when a third of Thailand was submerged and many residential areas including those in Bangkok were under water; the 2012 Government-subsidised First Car Policy – a first car-excise tax refund scheme to incentivise low income earners to purchase their first car to help revitalise the automobile industry, which led to tens of thousands of people defaulting on loans; and the country’s botched Rice Pledging scheme that guaranteed rice prices above market prices which backfired leading to losses of 682 billion baht in state government coffers (or 10 per cent of public debt) and more than 10 million tonnes of stockpiled rice. “The Great Flood and the First Car Policy combined caused household debt to be over 80 per cent of GDP,” he said. “Moreover, there were so many corruption cases involved with politicians and officials.”

There was networking over coffee and biscuits before and after the speech. Image copyright: Miles Willis Photography

He said no solution could be found to install peace and stability in Thailand but “to allow the situation to continue would have further set back the country several years. The military intervention might not be the first-best solution but the prospect of endless chaos would have been far worse,” he explained. “It is the best thing that the military have done this otherwise no one could see the way out. This Government’s first priority was to restore peace and order so that people could resume their normal activities and businesses could operate without disruption,” he added.

As a result of the military coup the Thai economy jumped to 1.6 per cent during the second half of 2014 compared to near zero growth during the first half of 2014, he said. “It was early September 2014 when we took office,” he pointed out.

He said the Government was planning for a budget deficit of around 2.9 per cent of GDP for the fiscal year 2016 “and next year we may have to increase the deficit to 3.5 per cent.”

The Bank of Thailand has reduced its policy interest rate twice this year, from two per cent to the current 1.5 per cent. VAT will be increased some time after September next year, he added.

He outlined further economic reforms which the military-led Government had carried out, many of which had been neglected by previous governments.

These include key tax reforms which “would enhance Thailand’s long-term competitiveness and ensure sustainable development,” he said.

The corporate income tax was now the second lowest in ASEAN at 20 per cent, he said. Customs tariffs on around 1,500 raw material and intermediate good items had been reduced; and for the first time inheritance and gift taxes would be enforced to reduce the wealth gap, he added.

The Thai Government was also bringing out a new property and land tax to provide increased revenue to state governments and deter land speculation. “I have been working very hard on this,” he said, explaining the current property and land laws were very outdated. “We had a land tax in the past but the rate was very low as it had been set 20 years ago.” But he said the new tax had proved unpopular with the public and media. “People hate it. It could take two to three years to become effective as we have to build up a tax base. We are looking at the future of Thailand,” he said.” He said future plans included reforming personal income tax by simplifying the tax structure and changing the personal allowances and implemening better tax administration to reduce loopholes. But he said the VAT and corporate income tax needed the “most work.”

“In Thailand companies are known for having two balance sheets so we hope that if they pay this permanently lower corporate income tax they will only keep one book. They have to be registered and we will provide machines to make it easier for them to do accounts,” Mr Phasee said.

Another boost to the economy was that a new younger governor at the Bank of Thailand ex-IMF economist Veerathai Santiprabhob had just been appointed to take charge from October 1 who would be focused on monetary policy, he said.

Infrastructure development was another way in which the Government planned to enhance Thailand’s competitiveness. He said the Government would expand its mass transit system adding 10 lines with a total length of 464km to the existing 101 km network in Bangkok. Expansion would bring down fares and reduce traffic jams in Bangkok, he said.

He said the country’s railway would be upgraded to connect to China and other countries and 228 km of highway built expanding Bangkok and its vicinity. He said the two international airports in Bangkok were being expanded and the Laem Chabang port, among others would be upgraded. “We want to encourage private sector participation in all these undertakings,” he said.

He mentioned the new PPP Act (which became effective in April 2013) which will “provide a more conducive framework for the private sector to involve in infrastructure investment projects.”

“We place a high priority on good governance and transparency in the procurement and PPP bidding process,” he said, adding the Integrity Pact and Construction Sector Transparency initiatives would reduce the scope for corruption and collusion.

“We can’t rely on Government borrowing. We need the private sector. I urge European investors to take advantage of this opportunity by participating in these infrastructure projects either directly through PPP or indirectly by investing in government bonds and other financial instruments. The bond market in Thailand is one of the most successful in ASEAN. The value of the bond market is more than 80 per cent of GDP with foreign participation around 20 per cent,” he added.

He said the Government also aimed to enhance Thailand’s position as the hub for trade and investment in the region by propelling Thailand to a high value economy in the near future. The Government has revamped its BOI (Business Ownership Initiatives) initiatives to attract modern industries with high technology and innovation content.

“Investors love to come to Thailand but there is not enough infrastructure and incentives. So we now need to provide more incentives,” he explained.

H E Mr Sommai Phasee is pictured talking to the CEO of Asia House Michael Lawrence. Image copyright: Miles Willis Photography

More incentives include six Special Economic Zones on the border with Myanmar and Laos with special incentives to attract businesses. This Government has extended lease terms for land to be used for industrial or commercial purposes by foreign companies to up to 50 years, instead of 30 years, he said.

The military-led Thai Government has also upgraded tax and non-tax incentives to encourage companies to establish international headquarters (IHQ) and international trading centres (ITC) in Thailand to service their regional and global operations. “Personnel working for IHQ or ITC will be subjected to less stringent migration and work permit process,” Mr Phasee said.

He also said Thailand was implementing the measures required for single ASEAN economic integration to be achieved at the end of this year. The country has set the Digital Economy as part of its national agenda and is committed to expanding high-speed broadband throughout the country, centralising government data and offering efficient e-government services to citizens.

He said that a draft Constitution was being worked on that would be put to referendum before democratic general elections expected at the end of 2016.

He concluded: “With stronger economic foundations, Thailand will be an even more attractive place to invest, to conduct business in as well as to have fun.”

Earlier in the morning Mr Phasee gave a private briefing to Asia House corporate members. Companies represented at the table included Tesco, Standard Chartered, Jardines, Telstra, Prudential, Shell, HSBC, PwC, BG Group, Kroll, KPMG, G3 and Arup.

HE Mr Sommai Phasee gave a private briefing to Asia House corporate members before he made a public speech. Here he is pictured with the CEO of Asia House Michael Lawrence at the briefing. Image copyright: Miles Willis Photography

naomi.canton@asiahouse.co.uk

Mamata Banerjee, the Chief Minister of West Bengal, India will brief Asia House corporate members on West Bengal’s economic prospects and the steps the government of West Bengal is taking to make the state a more attractive investment destination on Wednesday 29 July. For more information click here.

The Chinese Ambassador to the UK HE Liu Xiaoming will brief corporate members on Wednesday 5 August about UK-China relations ahead of the Chinese President’s State Visit to the UK in October. For more information click here.