Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Asia House’s Celine Madaghjian analyses the latest green energy and finance projects across the GCC ahead of COP28.

FIND OUT MORE ABOUT ASIA HOUSE RESEARCH

Asia House Analysis

Key messages

COP28 will be held between 30 November and 12 December this year in Dubai. It comes as Gulf states are increasingly realising the benefits of pursuing green growth strategies despite their long tradition as fossil-fuel producers. They see such green strategies as enhancing their individual sustainability transitions whilst pursuing much needed economic diversification and growth. The World Bank predicts that this strategy will catapult the Gulf Cooperation Council’s (GCC) combined GDP from US$2tn in 2022 to US$13tn by 2050. COP28 President and Abu Dhabi National Oil Company (ADNOC) CEO Sultan Al-Jaber wants the summit to deepen the private sector’s involvement in reducing carbon emissions, meaning greater engagement and input from businesses are expected during this year’s conference.

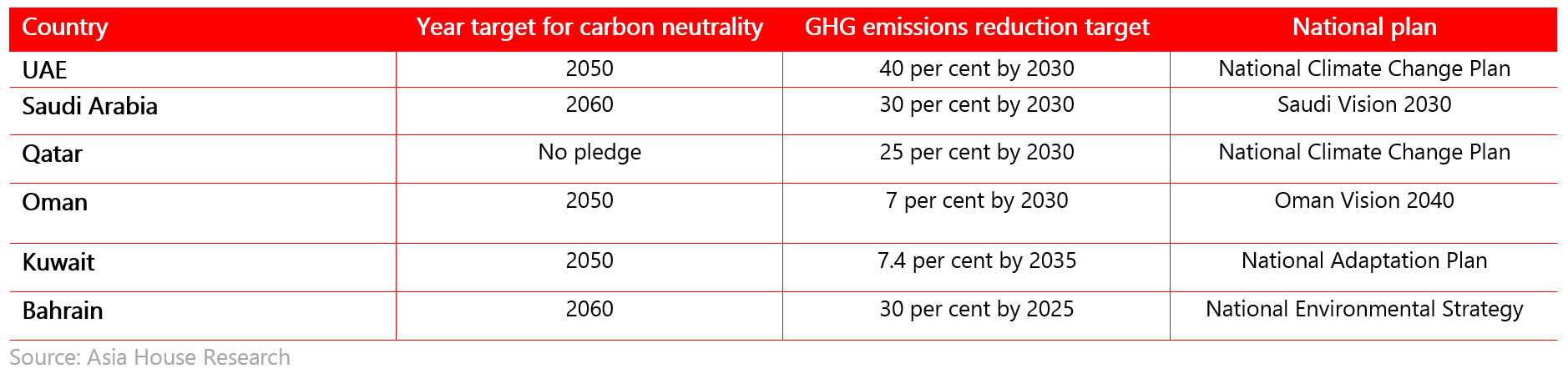

A brief overview of GCC climate pledges

GCC countries have signalled their commitment to mitigating climate change ahead of COP28, and in some cases have strengthened their commitments in recent months. The UAE, for example, announced it would cut carbon emissions by 40 per cent by 2030 – an increase from its previous 31 per cent target.

The region’s latest green deals

A result of this has been the skyrocketing number of green energy deals across the GCC by private and state-owned enterprises. The UAE and Saudi Arabia are leading the region’s climate-related initiatives by constructing renewable energy, hydrogen, and ammonia production facilities, with Oman and Qatar following suit.

The UAE is building one of the world’s largest solar plants, the Mohammed bin Rashid Al Maktoum Solar Park, which will produce 5GW of power by 2030, more than twice that generated by today’s largest plant, India’s Bhadla Solar Park. Meanwhile, ADNOC announced in July that it has brought forward its net-zero target from 2050 to 2045. ADNOC has also expanded its carbon capture technology as part of its plans to capture 5 million tonnes per annum by 2030, aligning with the country’s National Hydrogen Strategy.

Saudi Arabia is pushing to produce electricity sustainability under the National Renewable Energy Program. Saudi firm ACWA Power will produce 11.8GW of energy by 2025, making a significant contribution to the Kingdom’s goal of producing 58.7GW of renewable energy by 2030. Additionally, the Neom Green Hydrogen Company has partnered with the Saudi Industrial Development Fund to build the world’s largest ammonia production facility in Neom, the new urban area being built on the Red Sea. The plant is expected to produce 1.2 million tonnes of green ammonia per year once completed in 2026. Green ammonia is produced using electricity from renewable energy sources and generates low carbon emissions when burned, making it an alternative fuel that could assist global decarbonisation.

Oman is also rapidly constructing hydrogen plants following the announcement of its National Strategy for Green Hydrogen in October 2022. It aims to be the world’s largest producer and exporter of green hydrogen by 2030, with state-owned energy company Hydrom recently awarding contracts worth US$10bn to develop a green ammonia production plant. Construction will begin in 2027 with a yearly production capacity of a sizeable 1.2 million tonnes, some of which will be exported to South Korea, highlighting Asia’s importance as customers of Gulf ammonia.

Qatar, too, is making significant strides. QatarEnergy plans to build a blue ammonia plant worth US$1bn to turn natural gas into ammonia and carbon dioxide. It will employ Carbon Capture, Utilisation and Storage (CCUS) technologies to reduce the carbon emissions produced in the process. The firm will also start electricity production using solar power by the end of 2024 when it builds the Mesaieed and Ras Laffan Industrial Cities under the IC Solar Project, contracted by South Korea’s Samsung C&T.

The Gulf expands green finance

Gulf governments and firms are increasingly looking towards green finance to fund their energy transitions, stimulating this market. The Gulf sustainable and green bonds market achieved a record high in 2022, with issuances reaching US$8.5bn from 15 deals. For the first time, the debt market raised more funds for climate-friendly projects than for fossil fuel companies.

Further issuances of sustainable and green bonds have and will be completed in 2023. In July, UAE renewable energy firm Masdar raised US$750m in an oversubscribed 10-year secured notes auction. The money will support renewable projects. This came after Saudi Arabia’s Public Investment Fund sold its second-ever green bond in February, raising US$5.5bn, with proceeds going towards renewable energy, energy efficiency, green buildings, and clean transport.

Oman has taken significant steps towards developing green finance frameworks ahead of COP28, introducing a new draft Regulation for Bonds and Sukuk in June. In addition, companies such as Mazoon Electricity Company and Omantel have created sustainable finance frameworks, and the funds from their green bonds will be deployed towards renewable energy projects and the production of e-waste recycling products.

Qatar, Bahrain, and Kuwait, on the other hand, are currently trailing Saudi Arabia, the UAE and Oman in green finance. While the Qatari government announced plans to invest US$75bn in sustainable finance projects, Bahrain and Kuwait have been slower in expanding green investments.

Implications for COP28

The Gulf states remain major oil producers and exporters, with the sector driving their revenues; in 2022, the region’s GDP growth was at 7.3 per cent largely due to its oil production. Simultaneously, however, the green energy sector is starting to contribute to GCC economies, with non-oil GDP growth expected to average between 3 and 5 per cent in 2023. Consequently, the UAE, Saudi Arabia, Oman, and Qatar are reconfiguring their energy sector, demonstrating that carbon capture technologies, renewable energy and green ammonia production plants can mitigate sustained oil production and export. These GCC countries will deploy new expertise here to argue during COP28 that achieving net-zero is attainable even while maintaining oil production.

The Gulf states’ development of its green energy sector has benefited from private sector expertise and finance. COP28 President Sultan Al-Jaber has publicly stated the need to fully engage the private sector to galvanise collective action and raise sufficient capital to tackle climate change. Therefore, COP28 provides an opportunity for businesses to engage with the GCC on green projects. In particular, the private sector can work with Gulf states on the issuance of green and sustainable bonds, investable renewable energy projects, and the development of CCUS technologies.