Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

ASIA HOUSE RESEARCH

Phyllis Papadavid, Head of Research and Advisory

Phyllis Papadavid, Head of Research and Advisory

Phyllis Papadavid is a leading international economist and financial strategist with extensive research experience across the private and public sectors. She leads Asia House’s Research and Advisory work, driving the organisation’s research agenda and directing projects.

Key takeaways

– Trade and inward investment, particularly with the UK, will support India’s post-COVID-19 recovery. However, its business environment needs step-change improvement.

– A strong Indian economy is important for the US, particularly as an economic counterweight to China. Crucial to this is an agreement on trade restrictions.

– India’s relationship with China is at a crossroads; despite political tensions at India’s northern border, there has been head-turning growth in China-India trade. China is now India’s second largest export market, following the US.

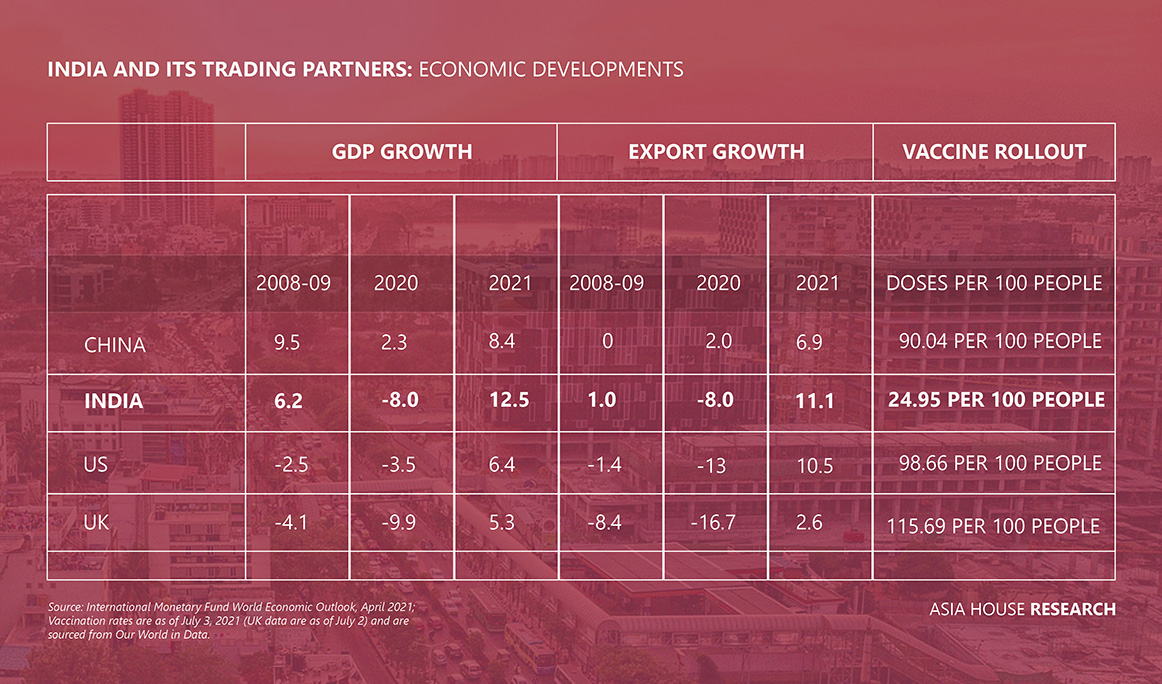

Until its recent wave of COVID-19, India’s economy was expected to grow 12.5 per cent annually in 2021 according to the International Monetary Fund – the fastest growth rate in the world, including in comparison to China’s predicted growth (8.4 per cent) and to that of the other BRICS economies. This estimate is likely to be revised downward given risks around India’s economic scarring from the crisis. The COVID-19 pandemic induced a collapse in both growth and exports (Figure 1). Recently announced economic stimulus will provide crucial support to India’s economy, companies’ balance sheets, infrastructure, and for rural development and health outcomes. Given India’s relatively high level of trade openness and its size, much of its rebound could come from its investment and trading relationships.

Figure 1

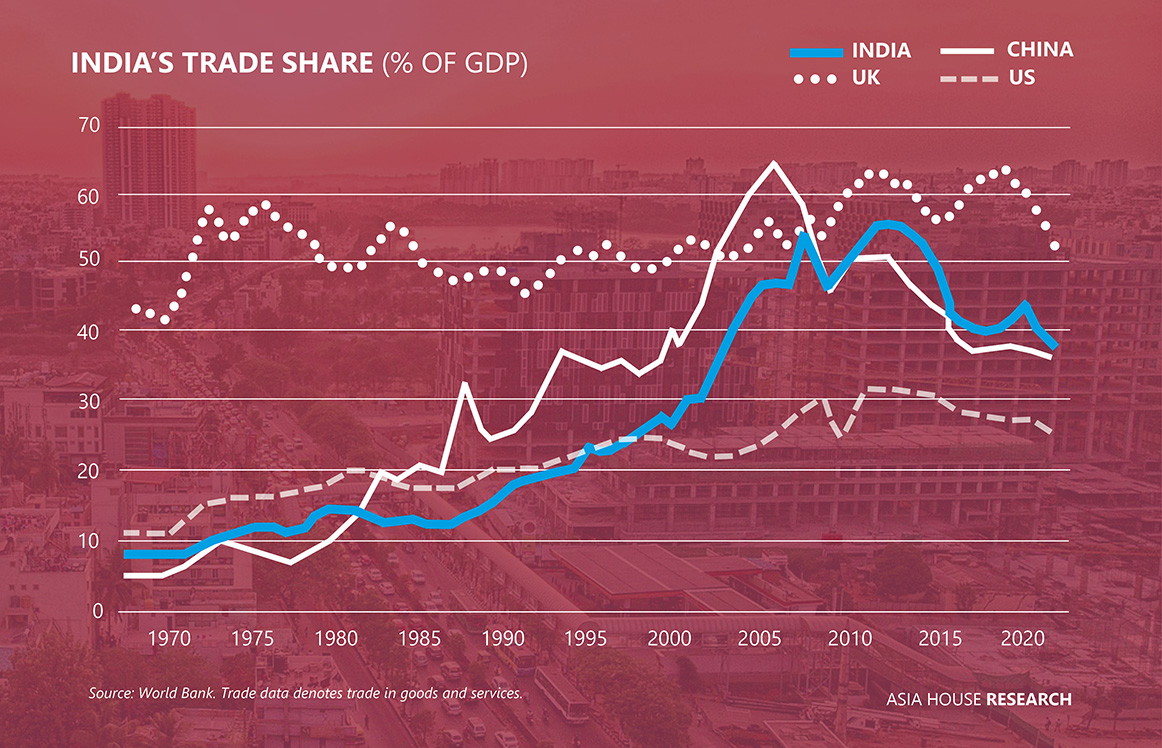

India is at an important juncture when it comes to its trade relationships. After having initiated and carried out a liberalisation programme starting in the 1990s, much like China and other emerging economies the global financial crisis of 2008-2009 marked the start of a downtrend in India’s trade: it has been in decline as a share of its GDP since 2010 (Figure 2). This stands in contrast with UK trade, which has seen a structurally more resilient decade. India’s growth is largely driven by domestic demand, rather than by exports. However, it is also likely that its trade policy has stalled, necessitating further policy action. In the past, India’s liberalisation propelled services trade growth. Services exports were up nearly 20 per cent from the late 1990s to right before the 2008-2009 crisis – roughly double the global rate in that period.

As the global economic recovery gathers momentum, there is an opportunity for India to build on its trading relationships, particularly through promoting the development of its digital economy. In January 2021 India’s Department of Telecommunications signed an MoU with Japan’s Ministry of Communications to strengthen cooperation in the areas of 5G technologies, telecom security and submarine fiber-optic cable systems. The Ministry of Electronics and Information Technology has a stated objective of increasing the contribution of the digital economy to 20 per cent of GDP. The technology sector also features in the £1 billion of new trade deals jointly announced between India and the UK.

Figure 2

Despite the COVID-19 pandemic shock, at US$15.5bn in 2020, India-UK bilateral trade was 11 per cent higher than in 2019. A trade deal would open India’s IT, garment, pharmaceuticals, footwear and chemicals sectors, some of which are at a disadvantage in the UK market compared to neighbours such as Bangladesh. The UK could access India’s consumer goods market, including for scotch whiskey; India’s tariffs have edged higher, with its tariff on scotch whiskey at 150 per cent. India’s skilled workforce, and its labour and tax reforms could catalyse UK outsourcing. However, sustained inward investment would require a step-change in its business environment; India ranks particularly poorly in the ease of starting a business and in contract enforcement.

Under the Biden administration, the US has been keen to discuss its strategic partnership with India. A strong Indian economy is important for the US, as it constitutes a more substantive counterweight to China. Crucial to this is an agreement on trade restrictions. Prime Minister Modi’s call for self-reliance does not bode well for trade, nor does India’s withdrawal from the Regional Comprehensive Economic Partnership (RCEP), which left Japan as the key counterweight to China. Similarly, India is not a member of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which also does not include China, again leaving Japan as the key lead. India’s absence from both trade partnerships demonstrates a particular direction of travel for its trade policy.

India has also proposed altering its e-commerce investment rules, a development which is likely to hurt its investment climate and impact major foreign tech firms’ domestic presence. It has been a particular source of contention with major US companies. The planned tightening of e-commerce rules (such as banning flash online sales) has triggered concern and opposition from Amazon, Tata (which has an online partnership with Starbucks in India) and Walmart’s Flipkart. Another regulation stipulates that foreign e-commerce companies cannot make direct sales to consumers and can only operate a marketplace for sellers. The US recently announced tariffs on India (and other countries) in response to the taxation of US technology companies.

India’s relationship with China is at a crossroads. Despite political tensions at India’s northern border, China is India’s second largest export market (following the US) and India’s number one import market. More recently, there has been head-turning growth in China-India trade. It rose 70 per cent in the first five months of 2021 to over $48 billion with Chinese exports up 64 per cent year-on-year and India’s imports up 90 per cent in the same period. The latter was driven in part by medical imports to fight India’s second COVID-19 wave. As with a number of other economies, India aims to reduce its import dependence on China’s intermediate goods, consistent with its ‘Make in India’ scheme. With up to 80 per cent of world trade estimated to pass through the Indian Ocean, competitive rivalry may increase. This is unlikely to translate into trade barriers against Chinese imports – thus far they have increased Indian households’ cost of living and have restricted manufacturing inputs.

India is set to be one of the world’s fastest growing economies; it is only a matter of time before its growth accelerates in a meaningful and broad-based fashion. And yet, in the near-term, it is at a crossroads with its major trading partners. The secular downtrend in its trade as a percentage of its economy, does not augur well. Openness has tended to support India’s growth and productivity. Building mutually beneficial trade agreements with its trading partners is particularly challenging given domestic barriers in its investment climate and current political tensions. Ultimately, for countries that have the size and breadth of India’s economy, policies leaning to liberalisation rather than different forms of protectionism bring about best outcomes.

JOIN OUR MAILING LIST to receive Asia House insights, analysis and research direct to your inbox.

FIND OUT MORE about Asia House’s research and advisory services.