Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

The Middle East Pivot to Asia 2023 report presents Asia House’s latest research on trade and investment trends between the Gulf and Asia.

The Middle East Pivot to Asia has accelerated significantly over the last year, with the Gulf Cooperation Council (GCC) countries experiencing a remarkable surge in trade with Emerging Asia. Trade between these regions soared by 34.7 per cent, increasing from US$383bn in 2021 to US$516bn in 2022. This report contains the latest analysis on the key bilateral relationships driving the Pivot, including Saudi-China; UAE-China; UAE-India; and Gulf-ASEAN relations. This report also provides granular detail on the latest Gulf-Asia cooperation and investments in key sectors, including financial services, technology, and sustainability.

Produced by the Asia House Research and Advisory team and sponsored by HSBC, the report aims to help business leaders and policymakers better understand this pivotal shift in global trade, which will have far-reaching economic and geopolitical implications.

KEY FINDINGS

EXECUTIVE SUMMARY

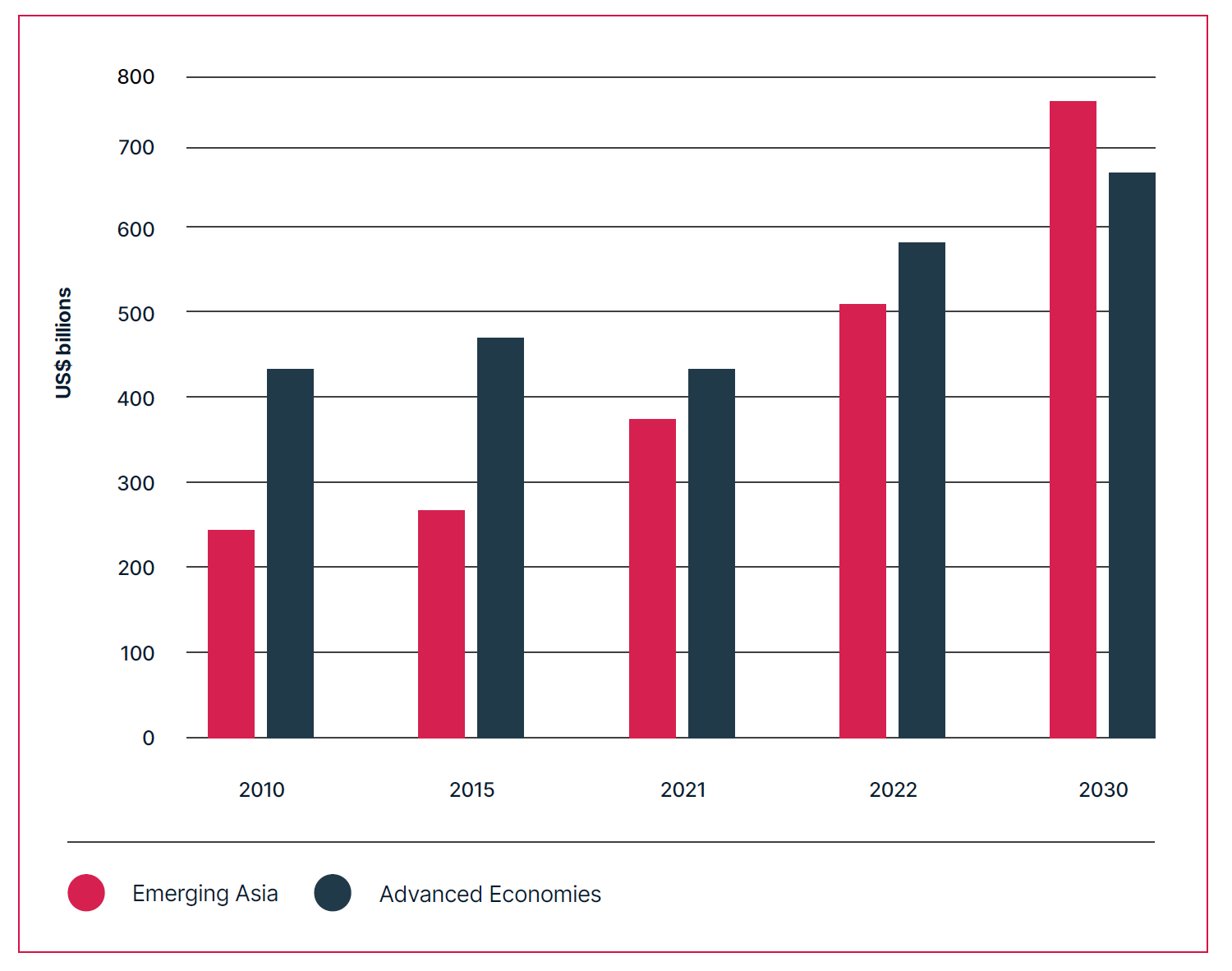

The Middle East Pivot to Asia has accelerated significantly over the last year, with the Gulf Cooperation Council (GCC) countries experiencing a remarkable surge in trade with Emerging Asia. Trade between these regions soared by 34.7 per cent, increasing from US$383bn in 2021 to US$516bn in 2022. Trade is growing faster than previous reports’ projections.

Should GCC-Asia trade continue to grow at the average annual growth rate realised between 2010 and 2019 (approximately 4.9 per cent), then it is set to reach approximately US$757bn by 2030 – almost doubling in value from 2021.

Growth can be attributed to higher average oil prices in 2022 than 2021, but trade expansion extends beyond oil. Non-oil sectors, particularly technology sectors that are vital for the Gulf’s economic diversification and digitalisation, have played a significant role. Sustainable cooperation between the Gulf and Asia, with a particular emphasis on China, is also rising. Synergies in renewables, hydrogen, electric vehicles (EVs), and green construction have propelled this collaboration. COP28 – taking place in the UAE at the time of this report’s publication – is expected to further encourage Gulf-Asia sustainable cooperation.

GCC Trade with Asia is catching up with Advanced Economies

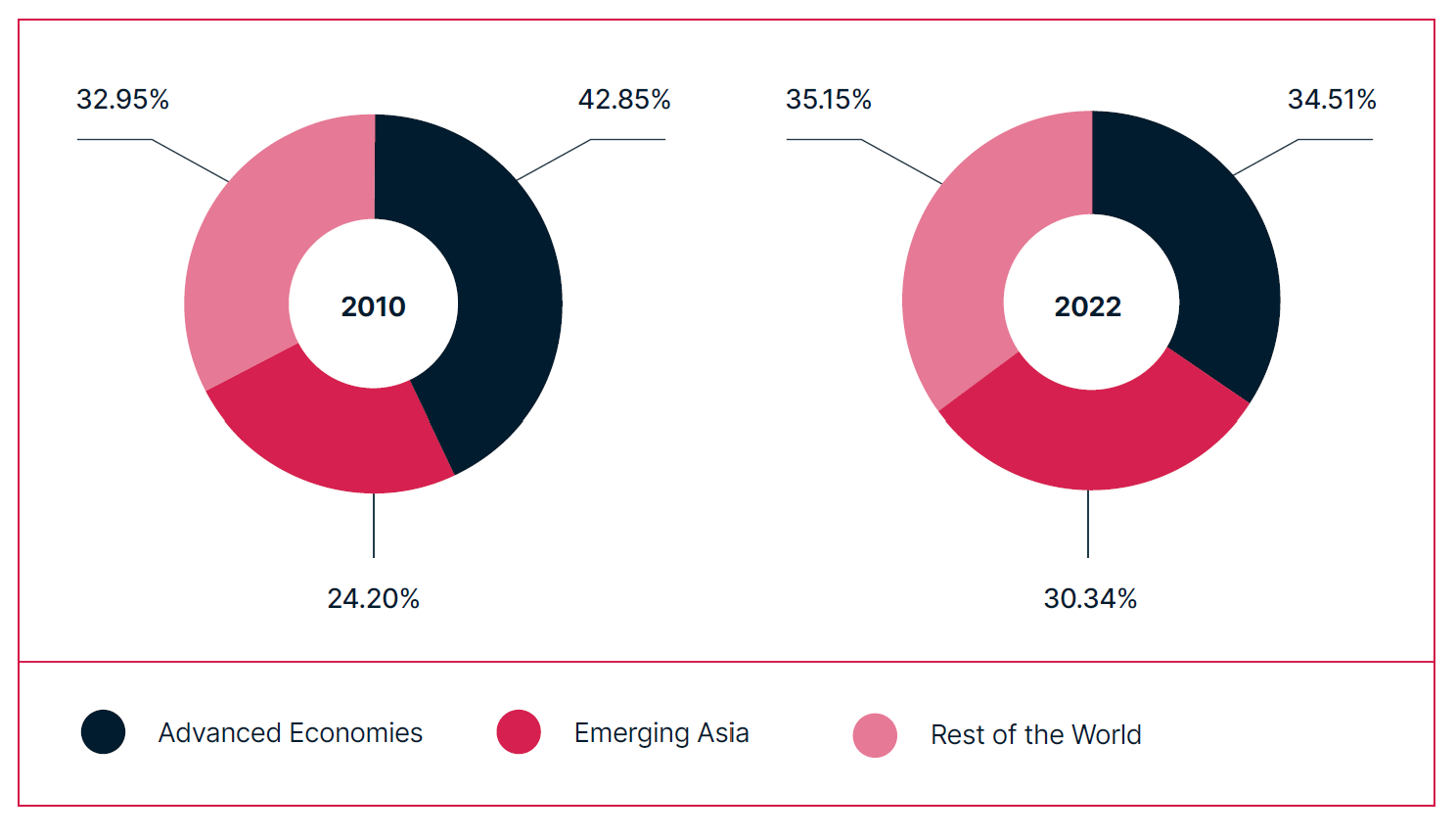

The Middle East Pivot to Asia is a major geoeconomic and geopolitical shift. Asia is fast overtaking the West as the Gulf’s key economic partner. Gulf trade growth with Asia continues to outstrip that with Western nations such as the US, UK, and Euro Area. Gulf-Asia trade rose by approximately 34.7 per cent between 2021 and 2022; whereas the Gulf’s combined trade with the US, UK, and Western Europe rose by approximately 32 per cent. Gulf trade with Advanced Economies was worth US$587bn in 2022, but our projections suggest that trade with Asia will soon surpass it, potentially by 2026.

China is a key driver of the Pivot. Gulf-China trade has risen by around 50.6 per cent over the last decade, and now nearly matches the Gulf’s combined trade with the US, UK, and Western Europe. China’s bilateral trade with Gulf nations is accelerating at a blistering pace. The UAE-China trade relationship is now the most significant in the Pivot, soaring by around 37 per cent from approximately US$78bn in 2021 to US$107bn in 2022.

Share of total Gulf trade with Advanced Economies, Asia, and the Rest of the World, 2010 and 2022. (per cent)

In both years the UAE’s trade relations with China surpassed its combined trade with the US, UK, and Western Europe. Saudi-China trade has jumped by around 28 per cent from US$82.1bn to US$105bn between 2021 and 2022 and will grow further in 2023 following Chinese President Xi Jinping’s visit in December 2022, which resulted in the signing of 35 deals worth US$50bn.

The continued internationalisation of the Renminbi (RMB) as a global trade currency could further enhance China’s economic sway in the region. RMB use in trade settlement has tripled in the last three years. It now accounts for about 6 per cent of global trade, surpassing the Euro. China is making progress in persuading the Gulf states to accept payment for their oil in RMB. In April 2023, Abu Dhabi National Oil Company (ADNOC) completed the Gulf’s first cross-border RMB-settled LNG trade with China. Further progress will accelerate the RMB’s internationalisation. China’s expanding economic influence in the Gulf is leading to greater involvement in regional politics, potentially reducing US influence. Saudi Arabia and the UAE’s accession into the Brazil, Russia, India, China, and South Africa group (BRICS) in 2024 will place them closer to Chinese decision-making and strategic thinking on global affairs.

Besides China, the Gulf’s bilateral ties with other Asian nations are flourishing. India’s trade with the Gulf has grown, encouraged by the UAE-India Comprehensive Economic Partnership Agreement (CEPA). Gulf-ASEAN trade continues to recover from COVID-19. October 2023’s inaugural ASEAN-GCC Summit in Riyadh underscores growing cooperation between the two regions, and the UAE’s drive to broker CEPAs with ASEAN’s main powers could boost trade further. Finally, Hong Kong has sought to strengthen ties with the Gulf, becoming an increasingly vital link for capital flows and business between the Gulf and Asia.

The long-term growth fundamentals for Gulf-Asia trade are robust. Trade will increase as Asia’s economies, middle-class populations, and energy demand expand over the next decade. The Gulf’s efforts to diversify their economies and develop non-oil sectors, especially in sustainability and technology, will further drive cooperation.

“The UAE-China trade relationship is now the most significant in the Pivot, soaring by around 37 per cent from approximately US$78bn in 2021 to US$107bn in 2022.”

The Gulf’s economic and social reforms, capital market expansion, and growing focus on Asia by Gulf Sovereign Wealth Funds (SWFs) are also expected to attract greater investment from Asia and drive the Pivot. The Gulf states have been liberalising visa access and modernising their labour practices to attract foreign investment and talent. In capital markets, there is a growing interest in dual-listing opportunities from Asian and Gulf companies, in each other’s respective markets.

Still, there are challenges. The recent Middle East conflict has made the region’s future more uncertain. The conflict could have an adverse impact on investment, which would worsen if the conflict broadens or deepens regionally. An escalation could impact the region’s energy producers, with a negative impact on energy prices, and dampen global growth by fuelling inflation and interest rate hikes. In general, 2023 has seen a deceleration in Middle East economic growth. Key Asian economies such as China continue to tentatively recover from COVID-19 in the face of an under-performing property market, high youth unemployment and reduced private sector confidence. Coupled with oil prices declining by around 17 per cent from 2022 to 2023, this could slow Gulf-Asia trade growth in 2023.

“Gulf-Asia trade rose by approximately 34.7 per cent between 2021 and 2022; whereas the Gulf’s combined trade with the US, UK, and Western Europe rose by approximately 32 per cent.”

US-China tensions have worsened over the past year and could also negatively impact the Pivot. The Gulf states seek to maintain good economic relations with both the US and China, but a continued deterioration in US-China relations could increase pressure on the Gulf states to curtail economic relations with one side in favour of the other. The US pressured Middle Eastern nations in 2023 not to cooperate with China on AI, with the restriction of sales of advanced US AI chips to the Middle East. Finally, while growing economic competition between the Gulf states is driving economic and social reform, there is a risk of it leading to protectionist measures that could undermine regional economic integration.

Asia’s growing economic importance to the Gulf is leading to greater political engagement and cooperation, shifting global geopolitics. As the Gulf’s trade and investment ties with Asia increase, we will likely see Asian viewpoints carry more weight in the strategic decision-making of Gulf rulers, and a waning of Western influence. The Middle East Pivot to Asia continues to be one of the defining geopolitical and geoeconomic shifts of our time and is worthy of greater attention and focus from global business and political leaders to capitalise on this growing opportunity.

The Middle East Pivot to Asia 2023 report was authored by Freddie Neve, Senior Middle East Associate at Asia House. Further written contributions were made by members of Asia House’s Research and Advisory team: Alana Li, and Celine Madaghjian.

This report has been sponsored by HSBC.

For more information about Asia House’s Middle East expertise and research services, and to enquire about bespoke presentations on the issues covered in the report, please contact Charlie Humphreys, Director of Corporate Affairs:

charlie.humphreys@asiahouse.co.uk

[1] The GCC comprises Saudi Arabia, the UAE, Qatar, Oman, Kuwait, and Bahrain.

[2] ‘Emerging Asia’ refers to the IMF’s ‘Emerging and Developing Asia’ list of 34 Asian economies, which includes China, India, and most ASEAN members, but excludes advanced Asian economies such as Japan, Singapore, South Korea, Hong Kong, Macao, Taiwan, Australia, and New Zealand.

[3] ‘Advanced Economies’ refers to an IMF list of 40 economies, including traditional GCC trading partners such as the US, UK, and Euro Area. Some Asian economies are included in this list, including Japan, Singapore, South Korea, Hong Kong, Macao, Taiwan, Australia, and New Zealand.

[4] The Euro Area is a category of countries which use the Euro currency. These countries are predominantly in Western Europe.