Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

In this Asia House research, Phyllis Papadavid, Senior Research Advisor at Asia House, explores the Macroeconomic shifts and digital developments which have increased the renminbi’s (RMB) share of global trade finance, propelling it to overtake the euro.

Key Messages

Summary

The renminbi’s (RMB) share of global trade finance is likely to continue to grow, notwithstanding the uncertainties in China’s growth outlook. Previous Asia House research highlighted macroeconomic and digital tipping points that could drive RMB internationalisation particularly in trade finance. The RMB share of global trade finance has now overtaken the euro’s share. RMB now accounts for nearly 6 per cent[1] of trade settlement, a near-tripling from September 2020. It has now overtaken the euro share of 5.3 per cent.

The latest assessment from Asia House suggests that the RMB will continue to exceed the euro’s share into and throughout 2024. The extent of the gap will depend on global economic and financial market stability, but it could be over 3 percentage points in a year’s time.

China’s continued digital expansion and cross-border trade and investment in energy will drive the acceleration of the share of RMB in trade finance. The RMB is not yet a fully functioning safe haven asset. However, it could continue to grow as a funding currency and an alternative settlement currency in economies that can no longer afford to fund their debts in US dollars.

China’s global financial footprint will be essential in underpinning the cross-border usage of the RMB in trade finance. Further RMB weakness is unlikely to disrupt the long-term resilience of RMB usage in light of China’s expanding trade finance and international payments infrastructure. However, lower global financial volatility would accelerate RMB usage.

The RMB share of trade finance now stands at nearly 6 percent and will rise further

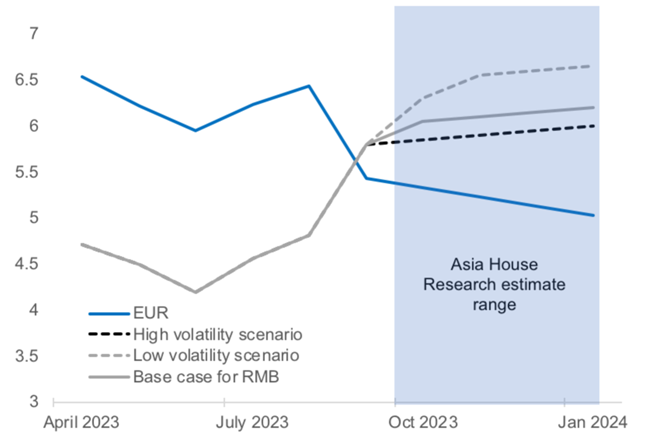

The Renminbi’s usage continues to accelerate notwithstanding the growing uncertainties in China’s growth outlook. As highlighted in our previous research, macroeconomic and digital tipping points[2] continue to catalyse the RMB in trade transactions and promote its internationalisation[3] in trade finance. The RMB’s share of trade finance has now surpassed the euro’s share[4] (Figure 1). If recent trends continue, our current assessment suggests that the RMB could substantively overtake the euro into 2024[5] depending on the degree of economic and global financial volatility.

Figure 1. RMB and euro share of global trade finance

(Percentage share)

Source: SWIFT; Asia House Research.

China’s digital expansion and cross-border trade and investment in energy have underpinned the acceleration in the share of RMB in global trade finance since the spring. This is likely to continue, though its overall share will continue to be in a significantly lower order of magnitude when compared with the US dollar. The lion’s share of trade finance (approximately 85 per cent according to SWIFT) is in US dollars.

We foresee three main scenarios in accelerated RMB use (Figure 1). There will continue to be an increase in the RMB share of trade finance given two structural trends:

The combination of increased digitalisation, the spread of innovative digital technologies applied to trade finance, and China’s energy demand are likely to continue to spur the rise of RMB-denominated trade-finance contracts, tools and initiatives vis-à-vis their main trading partners. Increasingly, these are emerging market economies with similarly aligned geopolitical and economic interests. China’s continued demand for commodities will also continue to invigorate the petro-yuan (Patterson and Manthey, 2023; Sun, 2023; Wang, 2023).

These structural trends underpin the Asia House projections of a rise in the RMB trade finance share (Figure 1). The magnitude of the acceleration in RMB usage and RMB-denominated payments in the months ahead will depend in part on financial market and economic volatility. How the RMB fares in relation to global economic developments (the “high volatility” versus “low volatility” scenario in Figure 1) will be essential.

With the global economic landscape characterised by intermittent, and sometimes acute, financial market volatility, slowing growth, stretched asset valuations and high debt levels, investor risk aversion will remain elevated for now. Geopolitical risks from both the Israel-Palestine conflict and the Russia-Ukraine war will also weigh on economic sentiment. Persistent investor risk aversion, or any further spikes in risk barometers such as the VIX[10], are typically supportive of the US dollar given its safe haven status.

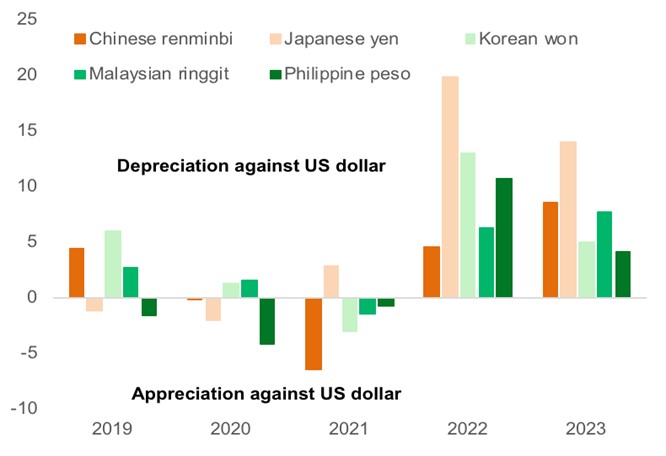

Global economic growth is expected to slow in 2024 with China’s economic deceleration likely to be notable in comparison to the rest of Asia. Additionally, the probability of a US recession as implied by the US interest rate market (Neely, 2023), has decreased but remains above 50 per cent.[11] And there could be potential spillovers from both the US and China. On this basis, US dollar strength is likely to continue at the expense of multiple currencies, including the renminbi (Figure 2).

Figure 2. Asia’s exchange rate developments in context

(Annual percentage changes)

Source: World Bank World Development Indicators; Author’s calculation.

RMB’s small but growing role as a safe haven asset and as a funding currency is relevant during a period that is likely to be charaterised by heightened financial volatility.

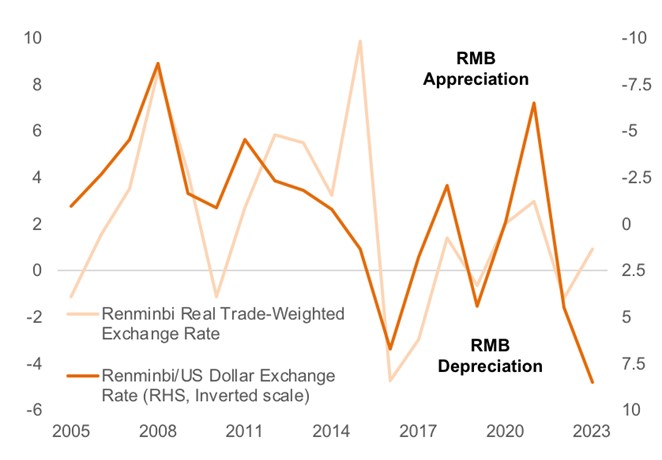

Figure 3. Trade-weighted renminbi and the RMB/USD

(Annual percentage changes)

Source: World Bank World Development Indicators; Author’s calculation.

The RMB’s share of global trade finance will continue to expand, notwithstanding the likelihood of its economic slowdown. China’s international investment position (IIP), its global financial footprint through onshore and offshore facilities[13], will be essential. China’s IIP is still low but exceeds the global average for emerging markets (many of which hold a negative position) (Gosh and Chandrasekhar, 2020).

A caveat to this building trend may be further RMB weakness. However, this is unlikely to disrupt the long-term resilience of the RMB, its growth in trade finance and international payments infrastructure. China’s trade growth and continued scaling of innovations in its digital economy will be essential.

Amid a growing IIP, greater institutional RMB payment facilities, and cross-border investment under the Belt and Road Initiative, the impetus for cross-border RMB settlement will continue to build (Reuters 2023; Schachtschneider, 2019; Geva, 2013).[14] Chinese banks will continue to spur the increase through continued acquisition of local banks in emerging market economies (Poenisch, 2021).

References

Afonso, D.L., Quinet de Andrade Bastos, S. and Perobelli, F.S. (2022), “Latin America and China: mutual benefit or dependence?” CEPAL Review No 135, December 2021, [PDF]] Accessed at: https://repositorio.cepal.org/server/api/core/bitstreams/f57b749c-78d5-4e7f-ab05-859fd20db144/content.

Cheng, X., Chen, H., and Zhou, Y., (2021), “Is the renminbi a safe-haven currency? Evidence from conditional coskewness and cokurtosis” Journal of International Money and Finance, Vol. 113, May 2021.

Chinn, M., and Frankel, J., (2005) “Will the Euro Eventually Surpass the Dollar as Leading International Reserve Currency?” National Bureau of Economic Research, No. 11510, August 2005.

De Rosario, J., and Campos, R., (2023), “Explainer: Argentina could again use yuan to evade IMF default”, Reuters, 27 July 2023.

Geva, B., (2013), “Global Payment and Settlement Systems” in Handbook of Key Global Financial Markets, Institutions, and Infrastructure, 2013, pp. 513-522.

Ghosh, J., and Chandrasekhar, C.P., (2020), “Developing Asia: The growing divergence between China and the rest” [PDF] Accessed at: https://www.researchgate.net/publication/346001768_Developing_Asia_The_growing_divergence_between_China_and_the_rest.

Neely, C.J., (2023), “What Is the Probability of a Recession? The Message from Yield Spreads”, Federal Reserve Bank of St. Louis, 7 September 2023.

Patterson, W., and Manthey, E., (2023), “The Commodities Feed: Strong Chinese oil demand” ING Commodities Daily, 19 October 2023.

Poenisch, H., (2021), “China’s global financial footprint” OMFIF, 24 June 2021.

Reuters (2023), “China ramps up yuan internationalisation under Belt and Road Initiative” Reuters Currencies, 19 October 2023.

Schachtschneider, J., (2019), “CIPS – China’s Cross-Border Interbank Payment System and Its Role Within the RMB Internationalization Process” (October 23, 2019). Available at SSRN: https://ssrn.com/abstract=4096107 or http://dx.doi.org/10.2139/ssrn.4096107

Sun, J., (2023), “Even a slowing China remains key to commodity markets” Lombard Odier Investment Insight, 4 September 2023.

Wang, R., (2023), “Copper CBS September 2023 – Robust China demand countered by stronger supply” S&P Global Market Intelligence, 28 September 2023.

[1]September 2023 SWIFT data reveal a 5.8 per cent share. See: https://www.swift.com/our-solutions/compliance-and-shared-services/business-intelligence/renminbi/rmb-tracker/rmb-tracker-document-centre?page=0.

[2]https://asiahouse.org/research_posts/the-renminbis-rise-and-its-accelerated-use-in-global-trade-finance/

[3]Internationalisation defined here along the framework of Chinn and Frankel (2005).

[4] See the SWIFT RMB Tracker for October: https://www.swift.com/our-solutions/compliance-and-shared-services/business-intelligence/renminbi/rmb-tracker/rmb-tracker-document-centre

[5] This excludes intra-euro-area payments.

[6]https://www.business.hsbc.com.cn/en-gb/campaigns/smarter-banking/global-trade-blockchain

[7]https://www.rmb.co.za/page/supply-chain-finance-for-firstrand-suppliers

[8]https://www.asian-risks.com/2021/12/22/credit-insurance-market-in-china-2/

[9]https://apnews.com/article/yuan-bolivia-trade-argentina-brazil-dollar-696bfb7c5ab68d4f0a87a7f6557678f0

[10]The VIX index is an indicator of expected market volatility. See: https://www.cboe.com/tradable_products/vix/

[11]At time of writing, this estimate is based on the US 10YR-3YR Treasury interest rate spread. https://www.newyorkfed.org/medialibrary/media/research/capital_markets/Prob_Rec.pdf

[12] See: https://www.whitehouse.gov/briefing-room/press-briefings/2023/09/08/press-gaggle-by-secretary-of-the-treasury-janet-yellen-ahead-of-the-g20-summit-in-india-new-delhi-india/

[13]See Poenisch (2021).

[14]This data has seen continued resilience. See: https://www.safe.gov.cn/en/2023/1020/2138.html.

Asia House provides a range of services to help organisations navigate complexities in Asia and the Middle East. For more information please contact Katie Reid, Stakeholder Engagement Associate: katie.reid@asiahouse.co.uk