Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Zhouchen Mao and Matilda Buchan from Asia House Research analyse the state of economic relations between China and the UK, identifying opportunities, as well as the prevailing political sentiment within the bilateral relationship. While relations between London and Beijing continue to be complex and challenging, the most recent trade statistics indicate an ongoing positive trend, suggesting significant opportunities remain.

FIND OUT MORE ABOUT ASIA HOUSE RESEARCH

UK Foreign Secretary James Cleverly’s recent visit to China highlighted the pragmatism that the Conservative government is embracing despite hardliners in its party ranks: it is balancing national security with selective engagement in trade and non-security areas.

While the Foreign Secretary had to walk a diplomatic tightrope, his visit was the first by a UK cabinet minister since 2018 and therefore carried considerable significance. The visit was followed by a bilateral meeting between UK Prime Minister Rishi Sunak and Chinese Premier Li Qiang on the sidelines of the G20 Summit in India, which marked the highest-level engagement in years.

Although there are deep political divisions between the two countries – over human rights in Mainland China and the governance of the Hong Kong Special Administrative Region, for example – economic interdependence lies at the core of China-UK bilateral relations. In short, bilateral trade in goods and services surpassed £110bn (US$137bn) in 2022 despite the political rhetoric. The trade relationship with China is substantial and has the potential to grow, especially in sectors that align with China’s development priorities. This includes automobiles, biopharmaceuticals, financial services, and renewables.

Bilateral trade relationship

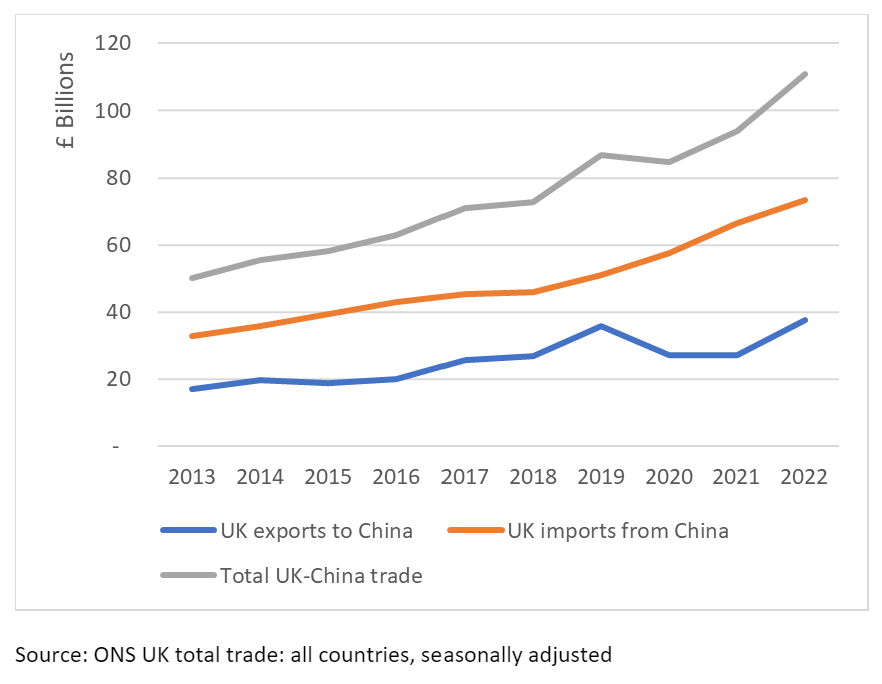

Bilateral trade between the UK and China has grown significantly in recent years, with trade values increasing at around 11.09 per cent annually on an average 1 (See Figure 1). As a result, there has been a substantial increase in the trade deficit.

Figure 1: China UK bilateral trade 2013-2022 (£bn)

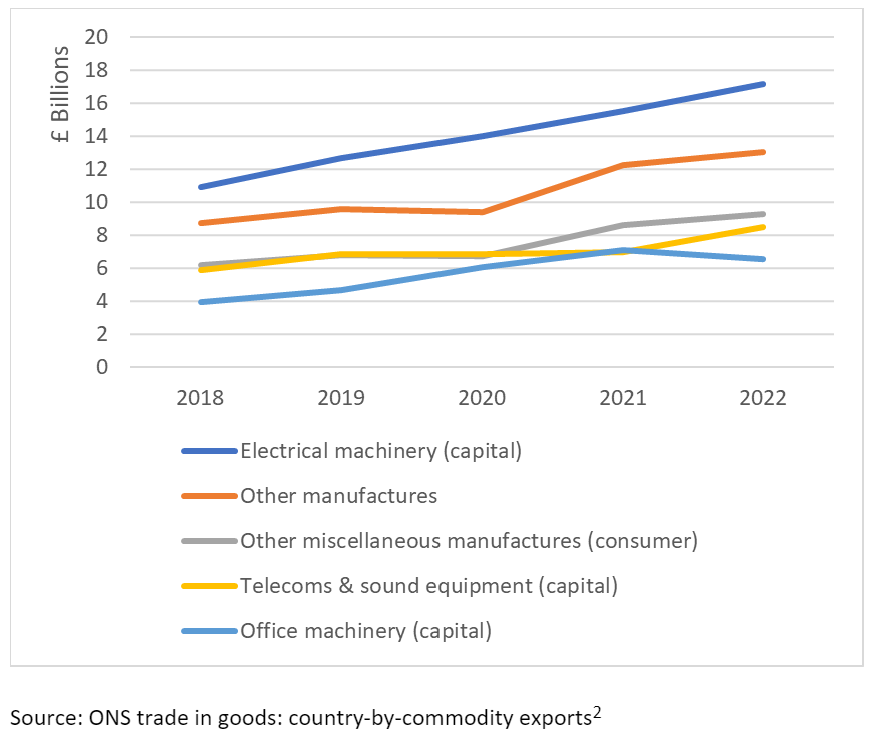

In 2022, bilateral trade in goods and services bounced back to pre-pandemic levels with trade in goods between the two countries accounting for 88 per cent (£97.9bn), an increase of 19 per cent from 2021. This upward trajectory is driven by continued rise in top imports of electrical machinery, telecoms and sounds equipment, and office machinery from China (See Figure 2).

Figure 2: Top UK goods imports from China 2018 – 2022 (£bn)

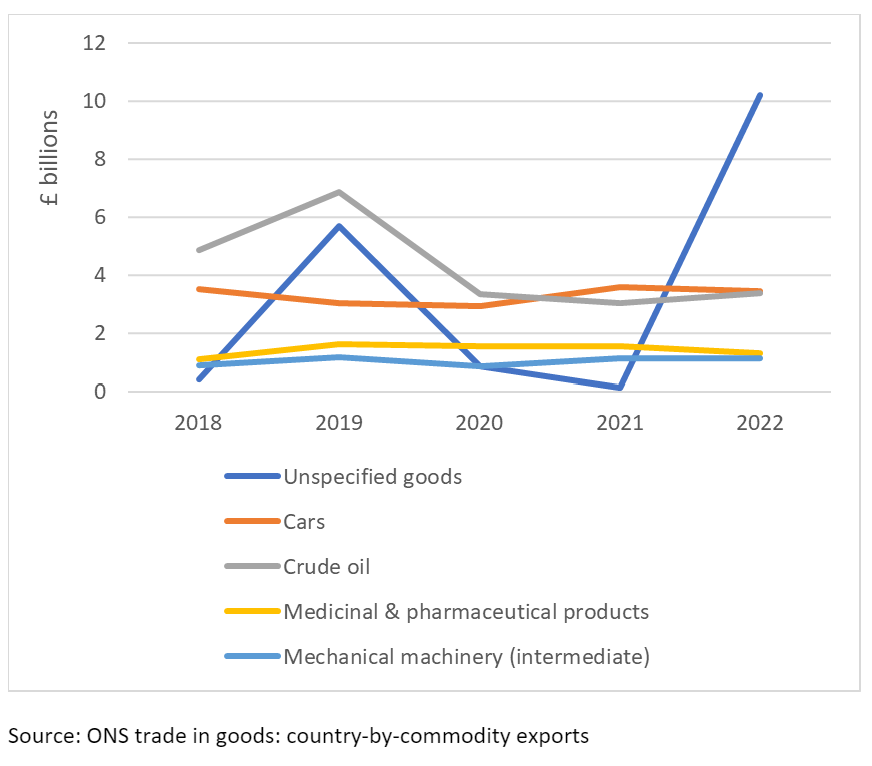

In terms of UK goods exports to China, trade value declined by 35 per cent, from £26.4bn in 2019 to £17.3bn in 2020, due to the COVID-19 pandemic. However, UK exports then rose slightly in 2021 and recovered to the pre-pandemic levels in 2022. In 2022, top UK exports of goods to China were unspecific goods, cars, crude petroleum, and pharmaceutical products (See Figure 3).

It is clear that the overall decline in UK goods exports has been driven by a significant decline in unspecific goods, the majority of which is non-monetary gold. Non-monetary gold represents trade of reserve assets and is often seen as a safe investment during times of economic uncertainty. The decline in UK exports of non-monetary gold to China reflects China’s cautious response to international markets during the pandemic.

Figure 3: Top UK exports to China 2018 – 2022 (£bn)

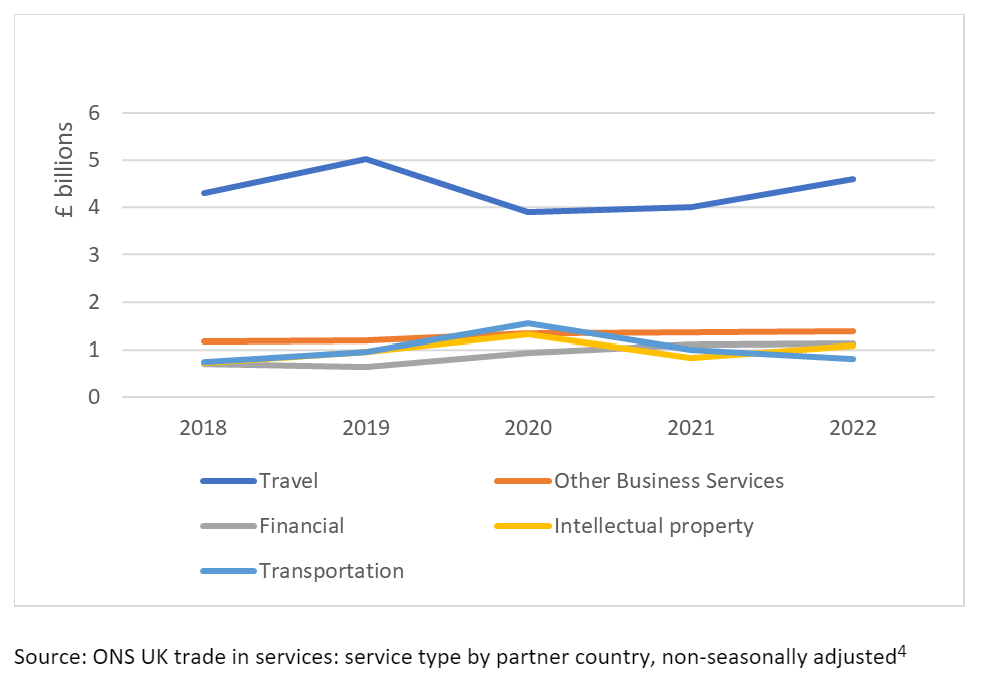

Where the UK has a significant comparative advantage, however, is in trade in services, which, bilaterally, totalled £13.1bn in 2022, representing 12 per cent of the total trading relationship. The UK has a trade surplus in this sector, with financial services, transportation, and business services3 ranking among the top five services exports to China. Tourism constitutes UK’s most significant service, illustrated by the sheer number of Chinese tourists traveling to the UK. That said, this figure experienced a 23 per cent decline during the pandemic and has not yet rebounded to pre-pandemic levels (See Figure 4).

Figure 4: Top UK service exports to China 2018-2022 (£bn)

Opportunities for UK businesses

The size of the Chinese economy makes it undoubtedly attractive despite the recent slowdown in growth and ongoing property downturn. As trade between China and the UK remains robust and continues to grow, the most significant opportunity arguably lies in increasing the amount of goods and services exported to China.

Considering that the UK’s market share constituted just 1.2 per cent of all goods and services imported by China, there remains plenty of scope to grow. In contrast to the US and Japan, the UK’s goods exports to China are primarily concentrated in the consumer market, rather than sensitive sectors such as semi-conductors. Under Chinese government initiatives of common prosperity and dual circulation5, along with a rising middle class, the country can have a pivotal role in bolstering UK exports.

Specifically, the automobile sector would benefit from Beijing’s push for electric vehicles as a key part of the industrial strategy, while biopharmaceutical companies can capitalise on the rapidly shifting healthcare industry driven by rising income, improving health awareness, and an aging population. Under the new guidelines issued by the State Council in August to optimise the country’s foreign investment, biopharmaceutical sector specific measures were discussed to enhance intellectual property protection, cross-border flow of data, and research and development investments. This decision is consistent with the government’s emphasis on attracting foreign investment in the biopharmaceutical sector, which Beijing considers a crucial area for expanding international collaboration.

The financial services sector, a key UK export, could also experience substantial growth. This could be facilitated by three factors:

In addition to financial services, the UK’s prowess in innovative technology aligns well with China’s focus on fintech development and digital innovation that could lead to partnerships in driving changes in the financial ecosystems. Sectors such as renewable energy and sustainable development will also continue to provide ample opportunities in combating climate change and promoting green initiatives.

The future of China-UK relations

Clearly, China and the UK share several areas of cooperation that range from global issues such as climate change and health, to bilateral engagement including trade. As the data above shows, there is scope for the UK to increase its bilateral trade with China. The UK more broadly is reaching to new partners in Asia following Brexit, and needs to increase its trade given the slow UK growth rate, persistently high inflation, and high interest rates.

But ongoing political tensions mean the UK government’s policy on China and any change in the nuance of the language or position on the relationship will come under enormous scrutiny both internally and from major allies such as the US.

A general election in the UK is expected by autumn 2024, but UK’s China policy will not change radically regardless of the outcome. The Labour Party holds a similar view to the Conservative government that China is a “systemic challenge” rather than an “existential threat”.

As outlined by Shadow Foreign Secretary David Lammy, Labour’s approach will be based on both ‘competition’ on issues related to national security and on ‘cooperation’ on trade and climate change. However, Lammy has previous said a Labour government would “act multilaterally with our partners” to seek recognition of China’s actions in Xinjiang as genocide through the international courts. Pursuing such a move would likely undermine the party’s policy to cooperate with Beijing on trade and climate, highlighting issues that could exacerbate bilateral tensions. The main risks to the China-UK trade relationship therefore remain political.

Asia House provides a range of services to help organisations navigate complexities in Asia and the Middle East. For more information please contact Charlie Humphreys, Director of Corporate Affairs: charlie.humphreys@asiahouse.co.uk