Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Driving commercial and political engagement between Asia, the Middle East and Europe

Gulf-Asia trade has soared between 2021 and 2022 with Emerging Asia set to be the Gulf’s biggest trading partner by 2026, according to Asia House’s latest research report on growing Gulf-Asia economic trends.

Gulf-Emerging Asia trade has surged by 34.7 per cent on the last year to a record US$516bn, according to new research by Asia House.

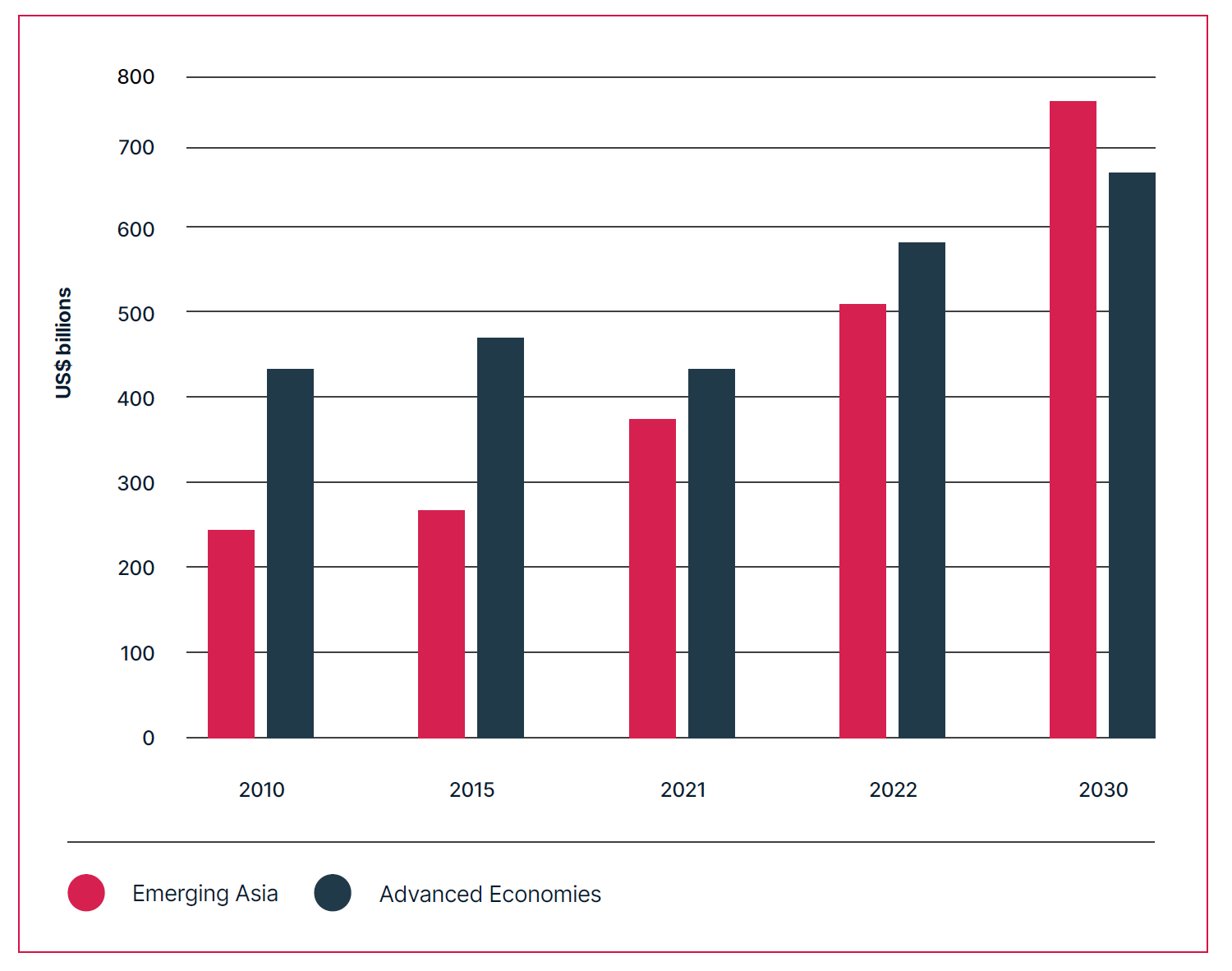

At current growth rates, trade between the Gulf Cooperation Council (GCC)* countries and Emerging Asia** is expected to overtake trade with Advanced Economies† in 2026 and will double to US$757bn by 2030 – representing a defining geoeconomic and geopolitical shift with far-reaching implications for global trade.

GCC trade with Asia is catching up with Advanced Economies

‘The Middle East Pivot to Asia 2023’ report also finds that China is a key driver of this trade growth. UAE-China trade has accelerated by around 37 per cent over the past year rising from US$78bn in 2021 to US$107bn in 2022 and for the second-year running has surpassed the UAE’s combined trade with the US, UK, and Western Europe. Saudi-China trade has similarly jumped by 28 per cent to US$105bn between 2021 and 2022. Trade is expected to benefit even further from Xi Jinping’s visit in December 2022, which resulted in 35 deals worth US$50bn.

The Gulf’s trade ties with India and ASEAN have also seen significant growth. October’s inaugural ASEAN-GCC Summit in Riyadh, as well as the UAE’s Comprehensive Economic Partnership Agreements (CEPAs) with India, Indonesia, and forthcoming CEPAs with Thailand, Vietnam, and Malaysia underscore enhanced cooperation.

Asia House’s research shows that while higher average oil prices in 2022 over 2021 accounts for some of this trade growth and that energy exports continue to be a key driver of Gulf-Asia trade, collaboration in non-oil sectors continues to grow. Sustainability in particular is emerging as a key nexus for cooperation, with COP28 expected to enhance Gulf-Asia sustainable cooperation.

Asia House expects Gulf-Asia trade to increase as Asia’s economies, middle-class populations, and energy demand expand over the next decade. The Gulf’s efforts to diversify their economies and develop non-oil sectors will further drive cooperation. The Gulf’s economic and social reforms, capital market expansion, and growing focus on Asia by Gulf Sovereign Wealth Funds (SWFs) are also expected to attract greater investment from Asia and drive trade growth.

The London-based think tank has also identified the growing internationalisation of China’s currency, the Renminbi (RMB), as a significant trend in the Pivot. RMB usage in international trade now accounts for 6 per cent of global trade, surpassing the Euro, with China making progress in persuading the Gulf states to accept payment for their oil in RMB.

Michael Lawrence OBE, Chief Executive of Asia House, said: “Gulf-Asia trade is soaring and is a defining geopolitical and geoeconomic trend of our time. The breadth and pace of cooperation between Asia and the Gulf across diverse sectors including technology, sustainability, logistics, and hydrocarbons is creating new opportunities, and is a bright spot in a global economy that is facing significant turbulence.”

“We believe this report will increase understanding of this important trend and will be useful for global business leaders and policy-makers in uncovering growth opportunities in an emerging era defined by closer Gulf-Asia economic and political cooperation.”

Industry insights

In addition to tracking the most significant trade, investment, and political developments in Gulf-Asia ties over the past year, ‘The Middle East Pivot to Asia 2023’ report also includes insights from business and policy leaders in the Gulf.

The report features interviews with HE Dr Thani Al Zeyoudi, UAE Minister of State for Foreign Trade; Stephen Moss, Regional Chief Executive Officer – Middle East, North Africa and Türkiye, HSBC; and HE Dawood Al Shezawi, President of AIM Congress.

Freddie Neve, Senior Middle East Associate at Asia House and lead author of the report, commented: “There has been a profound acceleration in the Middle East Pivot to Asia over the past year and the long-term growth fundamentals for Gulf-Asia trade remain robust.”

“The Gulf states continue to make progress diversifying their economies, leading to greater commercial collaboration between Gulf and Asian firms to grow the Gulf’s non-oil sectors. The emergence of new partnerships between Gulf and Asian stock exchanges, as well as growing Gulf Sovereign Wealth Fund interest in Asia, are also emerging developments shaping the Gulf-Asia trade landscape”.

“Asia’s growing economic importance to the Gulf is leading to greater political engagement, creating a virtuous cycle in terms of trade and investment between the two regions. The accession of Saudi Arabia and the UAE into BRICS, and Saudi Arabia signing on as a dialogue partner in the Shanghai Cooperation Organisation provide key evidence of this and further alters the geopolitical landscape.”

* The GCC comprises Saudi Arabia, the UAE, Qatar, Oman, Kuwait, and Bahrain.

** ‘Emerging Asia’ refers to the IMF’s ‘Emerging and Developing Asia’ list of 34 Asian economies, which includes China, India, and most ASEAN members, but excludes advanced Asian economies such as Japan, Singapore, South Korea, Hong Kong, Macao, Taiwan, Australia, and New Zealand.

† ‘Advanced Economies’ refers to an IMF list of 40 economies, including traditional GCC trading partners such as the US, UK, and Euro Area. Some Asian economies are included in this list, including Japan, Singapore, South Korea, Hong Kong, Macao, Taiwan, Australia, and New Zealand.

The Middle East Pivot to Asia 2023 report presents Asia House’s latest research on trade and investment trends between the Gulf and Asia.

Produced by the Asia House Research and Advisory team, the report aims to help business leaders and policymakers better understand this pivotal shift in global trade, which will have far-reaching economic and geopolitical implications.

For more information about Asia House’s Middle East expertise and research services, and to enquire about bespoke presentations on the issues covered in the report, please contact Charlie Humphreys, Director of Corporate Affairs: charlie.humphreys@asiahouse.co.uk